The increase in uncertainty that prolonged periods of lockdown due to COVID-19 is producing has seen investors moving to safer assets, with the US$ becoming a major port of safety. We’ve also witnessed a ‘dash for cash’ with the GBP/USD exchange rate hitting 1.156 on the 19th March 2020, the lowest it’s been in 35 years.

In addition to this, the Russia-Saudi Arabia price war coupled with reduced demand for oil (due to the virus), has driven the price to around $21 at present, the lowest oil price for 18 years.

The pandemic is also dividing opinion in terms of attitudes to ethical investing, and whilst it is true that ethical investing is still in its infancy, this is arguably the first true test for many Ethical funds. Their performance during this period could well shape investors tolerance for them in the future. With that in mind we have analysed the performance of some of the equity ETFs held within our SCM Ethical Portfolio against their traditional market cap comparable index ETFs:

iShares MSCI USA SRI ETF (YTD: -12.1%) vs Xtrackers MSCI USA ETF (YTD: -16.7.0%)

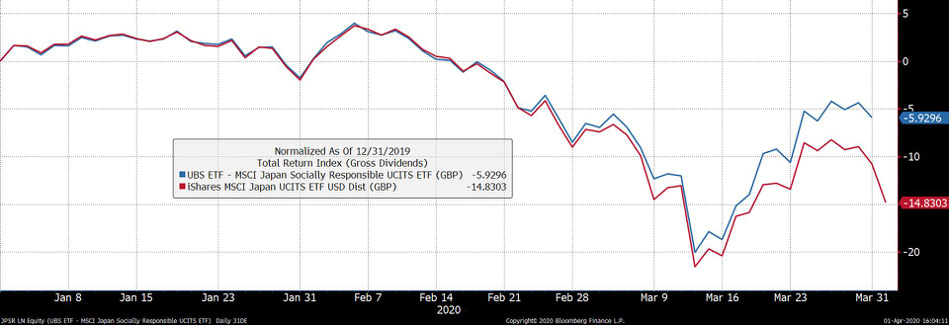

UBS MSCI Japan Socially Responsible ETF (YTD: -5.9%) against

iShares MSCI Japan ETF (YTD: -14.8%)

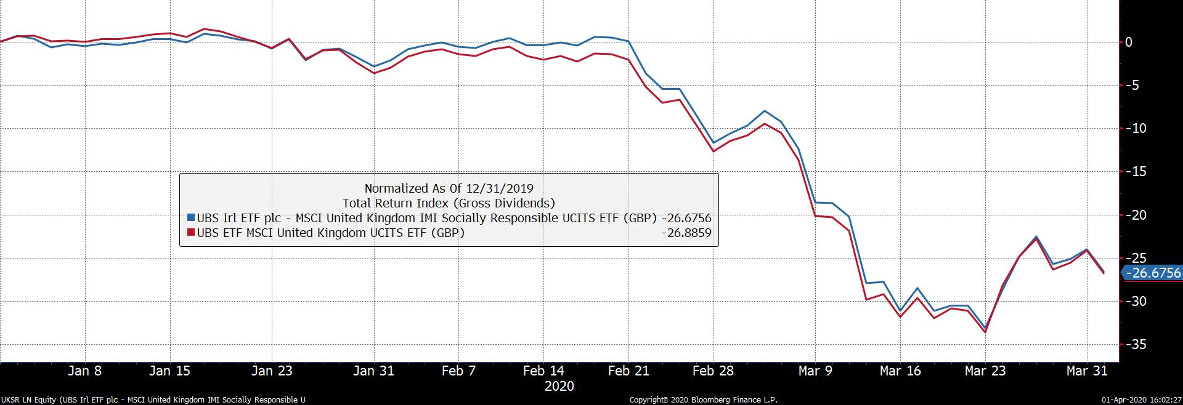

UBS MSCI United Kingdom IMI Socially Responsible ETF (YTD: -26.7%) against UBS MSCI United Kingdom ETF (YTD: -26.9%)

Xtrackers ESG MSCI Europe ETF (YTD: -16.5%) against HSBC MSCI Europe ETF (YTD: -19.8%)

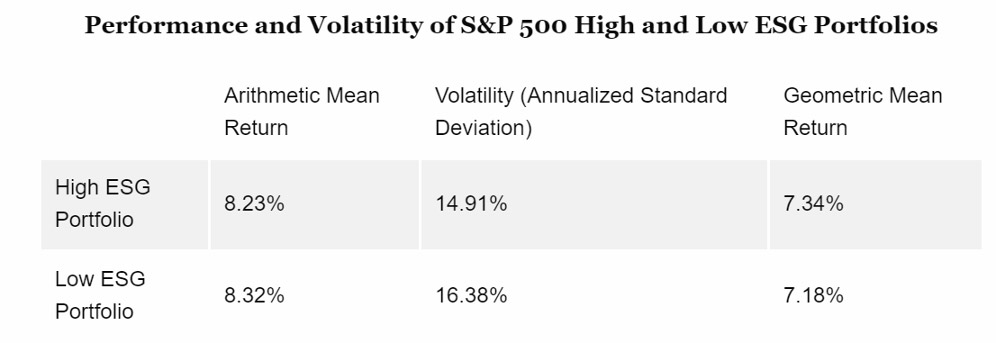

Ethical investing applies screening criteria that results in some sectors being underweight or not held at all. It could be argued that the reduced diversification has led to an increased systematic risk, with the outperformance witnessed simply being the reward for that extra risk. (Increased risk is usually measured in its volatility – Standard Deviation). But a study by the CFA Institute, utilising data from Refinitiv, a database that covers 7000 public companies and gives them an ESG score based on 178 data points does not support this suggestion.

The CFA Institute created two portfolios, one considered to have a high ESG score and one that had a low score, for all S&P 500 companies from January 2008 to December 2018. They found that volatility reduced rather than increased:

Source: CFA Institute

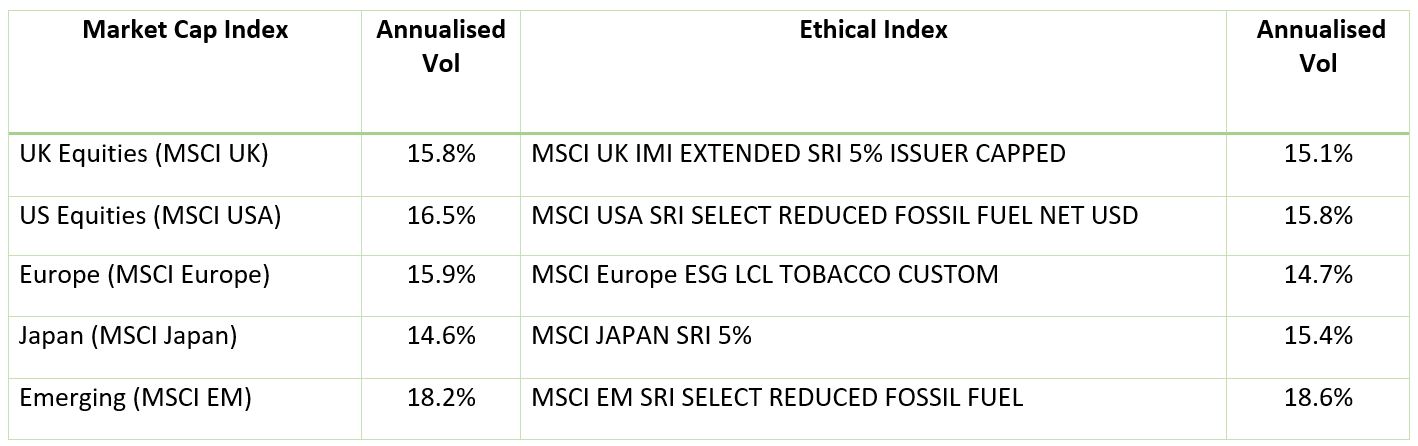

Using the indices followed by all the equity ETFs held within the SCM Ethical Portfolio, and comparing them with their comparable market cap index, we conducted a similar exercise to work out the annualised 3-year volatility of the SCM Ethical Portfolio to ascertain if the increased performance was due to increased risk.

Source: Bloomberg, as at 29/03/20

We found that Europe, UK and the US showed a reduction in volatility after the ethical screening used by MSCI (RHS). Only Japan showed any significant negative difference to holding the ethical index.

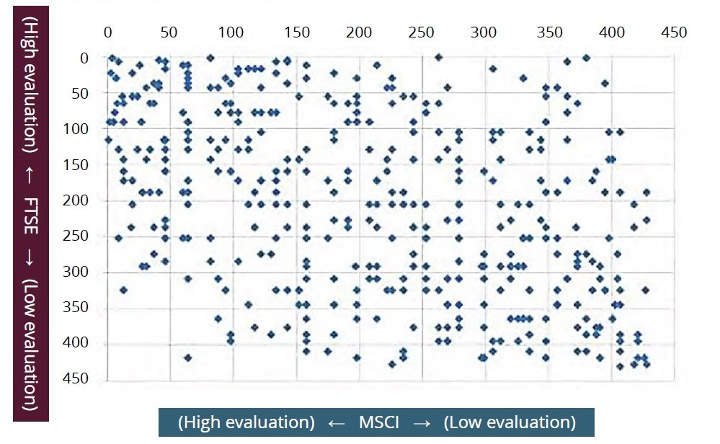

Research from MSCI found that “companies with good ESG ratings tend to be more profitable, have better quality and have lower risk”. However, it is well-documented that there is little correlation between index providers as to what a good ESG score is (see graph below the correlation between two major index providers). It is, therefore, of growing importance to have a third-party input when it comes to monitoring ESG data points and the specification for them.

Long-term impact of Coronavirus

We are now in a situation where we are getting daily updates on the Coronavirus pandemic and what it means for us on a practical level. Although none of us know how this will impact our lives in the longer term, we can be sure that it will. Th same will be true for companies, valuations and investments.

Working from home has forced many companies to adapt, forcing them to use technology to bring their teams together, for example using systems like Microsoft Teams and Zoom. Whilst it has meant businesses can continue, it could result in senior management concluding that they can operate with slimmed down workforces, less office space, and lower overheads generally. Whilst some companies downsize, others such as technology platforms, IT and telecoms companies will experience greater demand for their services.

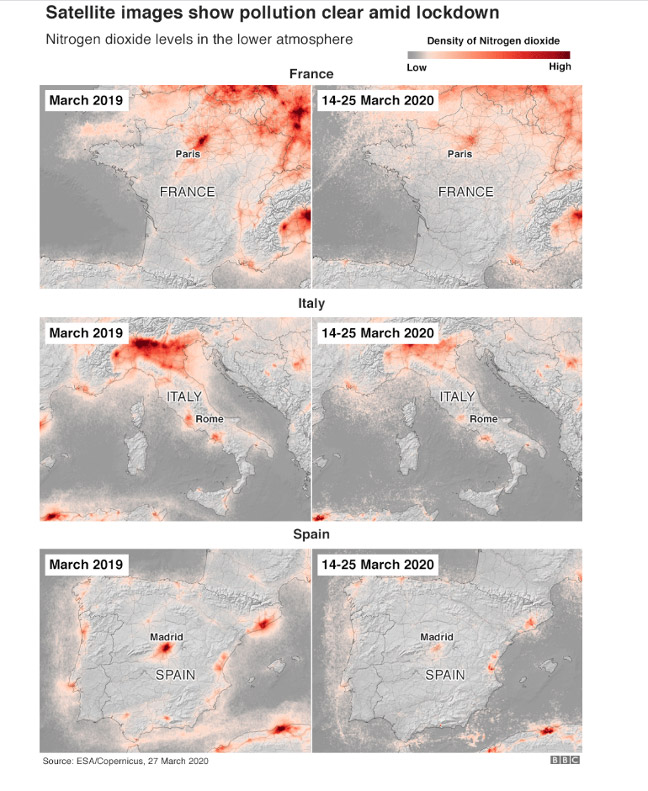

Another impact of the virus is that companies may also conclude that staff should travel less frequently, whilst individuals opt for walking or using Zoom and Skype to facetime friends and family rather than driving to meet face to face. There is also no denying that there have already been environmental positives of lockdowns and travel bans as countries report less pollution, returning wildlife and less energy usage.

The image below shows the difference in nitrogen dioxide levels in several European countries at present, compared to this time last year. The same has been witnessed across China. These dramatic reductions in pollution levels will affect the way we think about travel, climate change, as well as corporate behaviour.

Another impact of the virus is likely to be a significant reversal of austerity cuts, with increased funding of medical and emergency equipment, and staffing for health and community care services. The BBC has reported that the NHS has been suffering from a lack of resources. We could also see more funding goes into research and development of medical products, especially as fears of a second, even third wave of the virus remain worrying possibilities.

It may be too early to tell, and the performance of any investment fund should not be judged on a short-term basis, but many Ethical ETFs have outperformed their traditional peers in the recent downturn.

It will be interesting to see how they fare in any economic/market rebound. It may well be that they outperform over the whole economic cycle but at present, whilst signs are encouraging, it is too early to judge definitively.

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.