Apart from the more obvious dangers of investing in a country whose regime carries very high political risk, I believe there are more general lessons investors can learn from this latest crisis.

There are more unknown unknowns, than known unknowns so any investment professional that says they can predict the future is either a liar, an idiot or both.

Nobody (apart from Mr Putin) seemed to have known precisely whether or when or where Mr Putin was going to invade. Nobody knew what precise level of sanctions would be imposed and as a result, precisely which companies/bonds/sectors would benefit the most.

We still don’t, as markets are constantly updating their best view of the likely future and incorporating this into prices. Markets deal with uncertainty, as do fund managers.

As a snapshot into the Russian volatility, the iShares Russian ETF over the last 3 days has fallen 43% at present, having been 65% down at one stage earlier today.

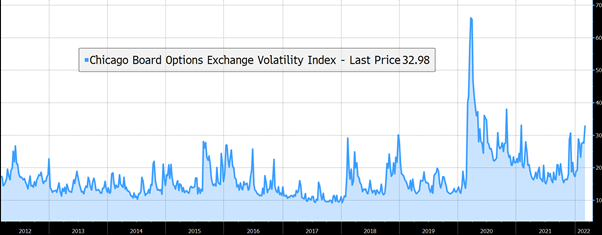

Overall market volatility has risen as measured by the VIX. The VIX represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 index, derived from the prices of index options with near-term expiration dates, thereby generating a 30-day forward projection of volatility.

This volatility is often seen as a gauge of market sentiment, and in particular the degree of fear among market participants – hence often referred to as the fear index.

We can see from below, that clearly risk and volatility has risen recently but to put it into context, the levels are lower than the volatility that followed the initial global covid outbreak:

No investment firm or fund manager can say with total confidence that event a is going to happen and what the effect of event b will result in. What we can say is that there are a range of possibilities and that the most likely is x and the most likely effect is y but that is all.

Similarly, did many highly paid analyst following Facebook (or Meta) predict that it was about to massively disappoint and its shares fall by a third, resulting in losses of $250 Bn of market value? This chart shows the market projections for the latest quarter have been falling since April 2021 but received a sharp reduction after the latest earnings announcement.

My tips to investors is to stay calm and concentrate on:

1. Diversification as this is the best risk management tool.

Yes, if every asset or part of the market is falling so will your investments, but by definition you will miss some of the worst effects.

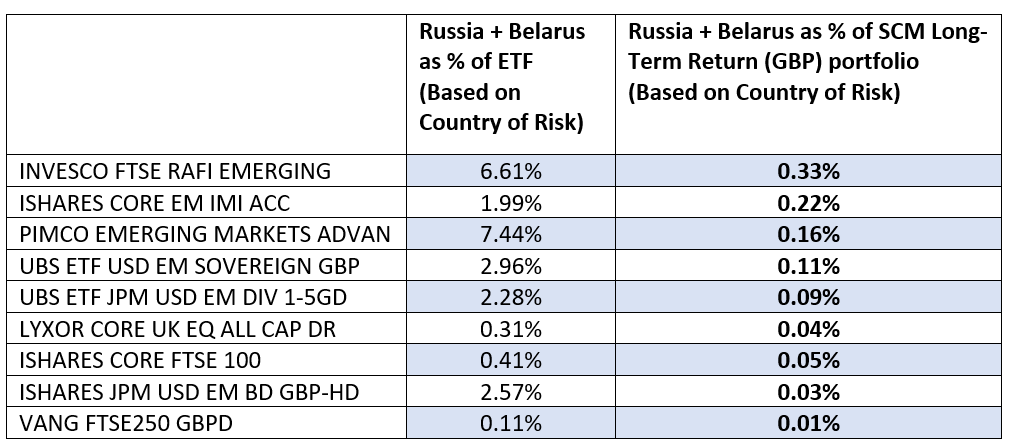

The SCM Long-Term Return Portfolio is testament to this strategy. It does have significant exposure to emerging market equities and bonds, but the question is how much Russian or Belarus bonds or equities does it hold? Within the Portfolio, there are currently 21 funds – of course the main exposures are within the Emerging Market equities and bond funds, but there is some Russian exposure closer to home (in the FTSE 100 and FTSE 250 funds).

Below is a table of funds held with our largest Russia/Belarus exposures as at 25th Feb 2022. The key is that by being diversified across a large number of other funds, with no or little exposure to Russia, the overall weighting within the Portfolio is just 1%.

Having said that, any exposure when a market falls by 50% intraday, is too much.

2. Liquidity gives you options. No liquidity, no options.

Interestingly, today the Russian stock market is closed with brokers ordered to “suspend the execution of all orders by foreign legal entities and persons who want to sell off their Russian investments, such as stocks and shares”.

I rang a well known UK unit trust manager with a £200m+ Russian fund and asked if they would be pricing their fund today – they told me that people will not be able to buy or sell their fund today “in order to treat their customers fairly”.

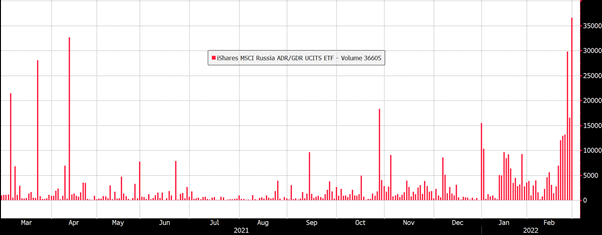

However, if you had bought or wanted to sell or even to buy Russia via an ETF you can because the liquidity and pricing mechanism allows for the fund to have a price (that matches buyers and sellers) even when the underlying market is closed.

Herein lies an enormous advantage of ETFs. You have more choice, more freedom and the price tends to reflect reality better in times of elevated uncertainty. Ironically, ETFs attract more volume and more liquidity at times of stress. For example, here is the iShares MSCI Russia ETF daily volumes over the last year:

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.