Research finds UK has seemingly become an Emerging Market in terms of its valuation.

As one of the UK’s first, and still few, active specialist Exchange Traded Fund (ETF) investment managers, the SCM Direct Investment Team conduct meticulous weekly screening for the most attractive ETFs based on a range of valuation metrics including consensus historic and projected earnings data, with an emphasis on searching for ETFs that offer a sensible growth to valuation metric.

Our most recent ‘Top 10’ research list of the most attractive ETF candidates was dominated by home offerings with six being UK large-cap ETFs and four European. The results used to be dominated by countries e.g., Russia, Turkey, or Emerging Markets. But now the UK has seemingly become an Emerging Market in terms of its valuation.

On 13th October 2020 we wrote a blog called ‘6,000 reasons to be bullish about the UK Stock Market’ since when the UK market (as measured by the FTSE All-share Index) has risen by 25.5% which in GBP terms compares favourably with the US S&P 500 Index (+20.4%), the MSCI Europe Ex UK Index (+20.9%), Japan (16.9%) or Emerging Markets (+10.0%). However, in recent months other markets, particularly the US and Japan have considerably outperformed the UK.

The question posed within our October 2020 Blog was ‘did the UK discount factor more than adequately reflect uncertainty regarding a UK/EU trade deal, coronavirus, low exposure to tech/high growth stocks amongst other reasons?’ Almost a year later, one could of course argue that the uncertainty of whether there was going to be a UK/EU trade deal has been resolved and the UK’s position relative to other countries in relation to coronavirus improved thanks to the vaccination roll-out success. But instead of that discount narrowing, it has widened.

Many commentators say (fairly) that part of the reason for the low rating of the UK is its concentration in lowly rated banks and oil & gas companies rather than faster growth tech stocks. Our October 2020 research argued that the fairest way to assess the UK discount was to look at all the individual stocks with available data in the FTSE 100 and then compare their current forward Price-Earnings ratio against similar stocks worldwide. For example, Astra Zeneca was compared with Glaxo, Novartis, Sanofi, Novo Nordisk, Merck, Eli Lilly, Pfizer, Bayer etc.

This we believe was a way of comparing like with like, to test whether there really was any form of UK discount that was not accounted for by the types of stocks prevalent in the UK stock market.

SCM Direct found that the weighted average discount of a UK FTSE 100 stock in October 2020 was 15% to its global peers. It’s even greater now at 17.4%. We analysed the various FTSE 100 stocks with available data, comparing their prospective P/E ratio against their global peers.

You might think that this discount is simply a function of the US peers being highly valued but whether you compare this prospective P/E ratio against world stocks, including or excluding the US, the same trend is clear, UK stocks are more cheaply rated than they have been for the last 10 years:

Source: Bloomberg LP

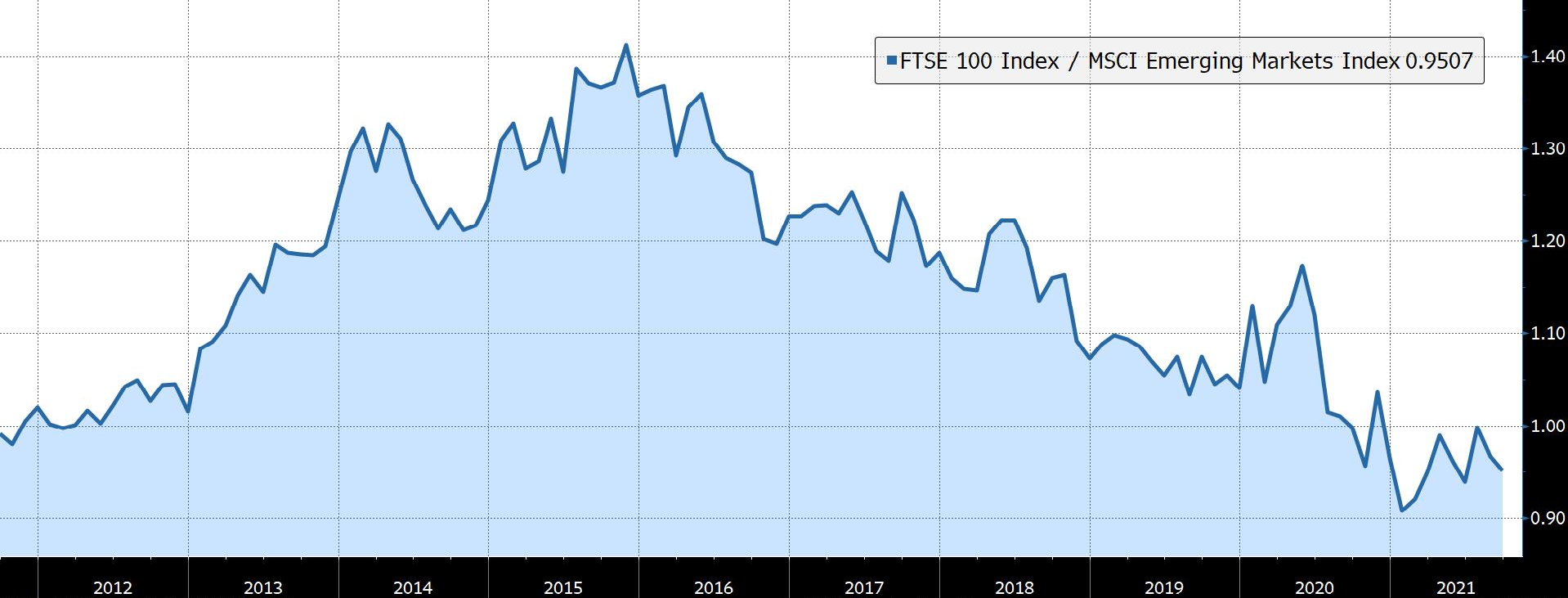

For many years, the UK would trade at a premium valuation to emerging markets. That is no longer the case. As the chart below shows, their prospective P/E ratios are now very similar:

Source: Bloomberg LP

Within the UK, the premium rating accorded to the more domestic-orientated mid-sized stocks may reduce as expectations of a sharp recovery soften, given the impact of higher taxes and continued uncertainty regarding coronavirus.

Currently, the premium in terms of next year’s projected earnings, for the mid-sized stocks (FTSE 250) is 36% as compared to the large blue-chip stocks (FTSE 100):

Source: Bloomberg

Sometimes, big and boring can deliver the best results. In the UK, that time might be fast approaching.

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.