Since our research into fund liquidity was published in the Sunday Times article ‘It’s crunch time. How quickly will you be able to get at your cash?’ [1] on 16 October, we have looked closely at the response from Gresham House into the fact that their fund came out bottom in our liquidity analysis.

Gresham House said: “Using data from 31 May 2022 does not reflect the current liquidity position of the fund, which has 19 per cent in available cash and undrawn cash facilities. It is important to ensure that investors are aware of liquidity, especially at times of heightened market uncertainty. However, this data does not reflect our liquidity framework, which has enabled the fund to navigate numerous periods of market stress.”

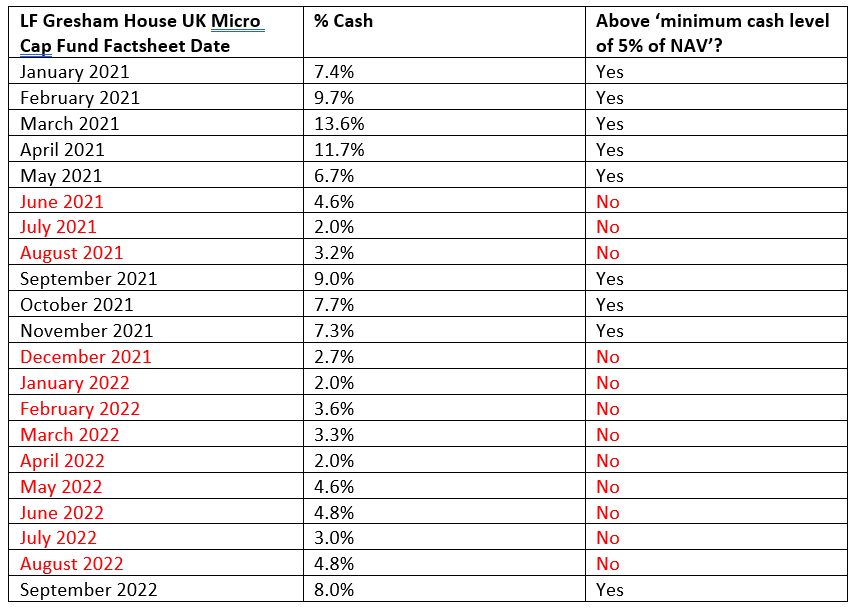

Gresham House mention a ‘liquidity framework’ and if this framework is the one they have hosted on their website (dated October 2019) called ‘five liquidity rules for owning small caps’ [2], then it appears to be made from straw, as our research shows they regularly breach one of their own liquidity rules that states:

‘We target a minimum cash level of 5% of NAV and typically operate within the range of 5-10%.’

We looked at every published factsheet for this fund from 2021 onward to test whether this ‘liquidity rule’ had been put into practice. We found that in nine consecutive months, the target had not been met [3].

I wonder if Link Fund Solutions Ltd (who are the ACD for this fund) have reviewed the liquidity rules which Gresham House have published but which our analysis shows are frequently not met?

Yes, Link Fund Solutions, remember them? The firm that supervised the Woodford Equity Income Fund, and who have recently received a proposed £50m penalty and a redress payment of up to £306m in connection with its ‘failings in managing the liquidity of the Woodford Equity Income Fund’ [4].

As to the excuse from Gresham House that because it has ‘undrawn cash facilities’ somehow these really should be used to finance large withdrawals is astonishing in our view. Does Gresham House really think it would be fair for the remaining unitholders if a cash facility (i.e. borrowing) would be used to finance potential redemptions? This could lead to a situation where a unitholder who does not redeem is left in an indebted fund. How can this be in accordance with the FCA rules of Treating Customers Fairly (TCF)?

The FCA recently said:

‘A cash buffer is not, however, necessarily enough to solve the problem. Sometimes, the incentive for investors to redeem before the cash buffer is exhausted, could even exacerbate redemption pressure.

Let’s say that investors look at the current dealing price of the fund, and consider it higher than the price that could be achieved by selling a representative sample of the fund’s assets quickly – by ‘quickly’ I mean fast enough to meet others’ expected redemption requests as they fall due. There could be an incentive for investors to make redemption requests now, before others do.

If the fund’s redemption arrangements do not counterbalance this ‘first mover advantage’, the lower returns or losses could instead fall on those who remain in the fund. This asset-liability mismatch in the fund’s structure, and the first mover incentive, introduces a source of instability in the fund.’ [4]

Maybe it’s time for the FCA to have a review of this and other smaller company funds with a view to protecting retail investors?

Sources:

[1] https://www.thetimes.co.uk/article/its-crunch-time-how-quickly-will-you-be-able-to-get-at-your-cash-wk69pswgv

[3] https://greshamhouse.com/strategic-equity/public-equity/lf-gresham-house-uk-micro-cap-fund/

[4] https://www.fca.org.uk/news/speeches/open-ended-funds-investing-less-liquid-assets

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. SCM Private does not give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios please contact an independent financial adviser.

SCM Direct is a trading name of SCM Private LLP which is authorised and regulated by the Financial Conduct Authority to conduct investment business No. 497525.

SCM Private LLP is a limited liability partnership registered in England and Wales No. OC342778.