Many of us were brought up to believe the best investment is property but is that true?

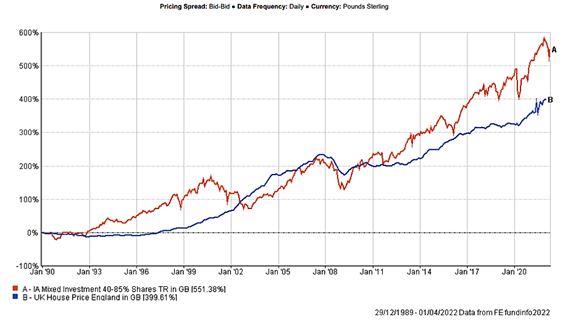

Given how stretched UK house prices appear to be, particularly in the Southeast of England, I thought it would be worth examining the data and longer-term charts. I started off with the longest period available from one data provider to see how the average UK house price had performed against a mixed fund of bonds and shares – similar to our own SCM Long-Term Return Portfolio strategy.

We found that the typical balanced fund of shares and bonds, after costs, produced a higher return than housing – 551% return vs a 400% return. Returns that do not include the costs of buying and selling houses, estimated at 2.3% (excluding deposit) of the average purchase price [1] and c. 2.1% of the average selling price [2].

For an investment fund, there would be a charge of holding the fund on most platforms – let’s assume 0.35% pa. Once you add in these extra costs, the return from the fund would be 494% vs 382% on the mixed investment fund. I have calculated this before tax as the tax situation will vary enormously depending on whether it is the prime or secondary housing or whether the investment is in a tax wrapper, such as a SIPP, or not. Similarly, some may argue that our analysis is unfair as we have not included a potential rental yield from letting out housing, which has been c. 3.2% per annum in England recently [3] but this excludes any management and maintenance costs associated with renting out a property. Furthermore, had we compared housing against a 100% equity portfolio rather than a balanced portfolio of shares and bonds, the comparative annualised returns would have been higher anyway.

There is also the liquidity element. You can normally invest or divest and receive funds from an investment fund back into your bank account in a matter of days, rather than an average 3 months to sell a property [4].

What history shows.

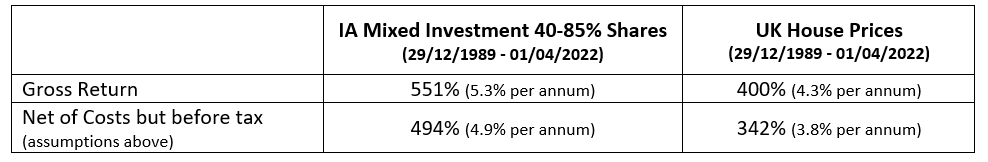

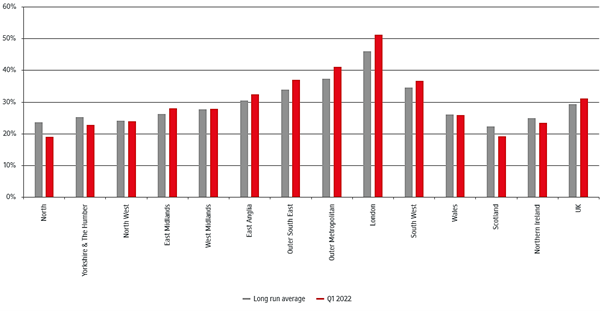

If we compare house price valuations to global share valuations the two seem poles apart. It has been recently reported [5] that U.K. House Prices rose 14.3% year on year, their largest rise since 2004 and 21% since the start of the pandemic spurred on by tax incentives, low borrowing costs and people seeking to move out of town during the pandemic. Other housing data, shows that the rises have been much greater outside London than in London:

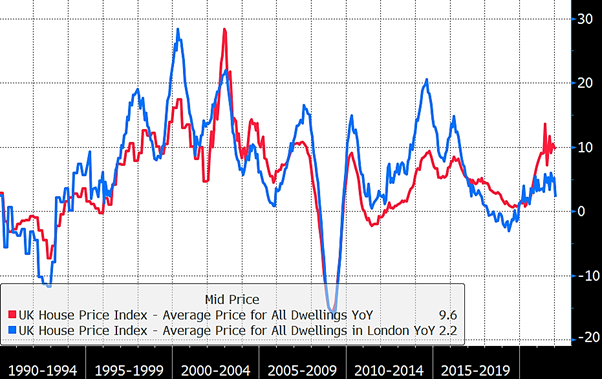

As this chart below shows, for first time buyers, because of rising interest rates, it is becoming much more difficult to afford housing, having become progressively cheaper since the end 2007 peak.

However, when one factors in that the base rate is forecast to rise from the current 0.75% to 2% by this time next year, a ‘Follow on Rate’ Santander Mortgage [6] would see its overall rate going from 4% to 5.25% per annum, equating to a 13.5% increase in a 25 year mortgage [7].

On this alone (and remembering that most people’s incomes are not rising as fast as inflation) buyers would experience mortgage payments as a percentage of mean take home pay rising from the current 33.3% to 37.5%, the highest since December 2008:

In London, first time buyer mortgage payments are already more than 50% of take-home pay, before any increased mortgage payments:

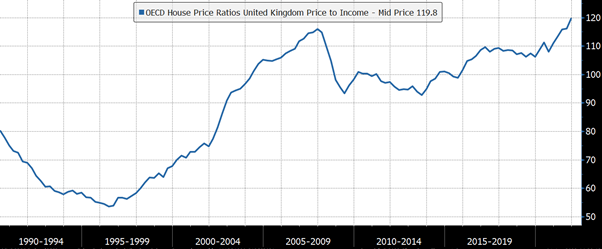

Meanwhile the ratio of UK house prices to income is now at its peak since 1990:

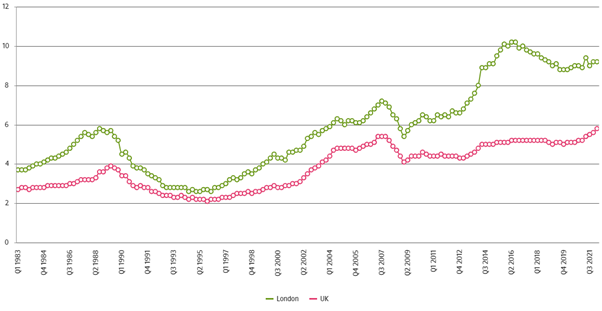

Whilst London house prices to income multiples have fallen back since their 2016 peak, they remain elevated by historical standards:

First Time Buyer (FTB) house price earnings ratios

What about Stocks?

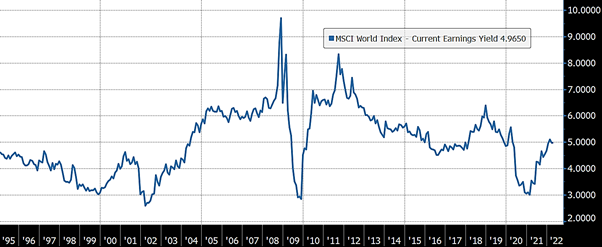

The valuation of world equities (which already incorporates the much higher valuation of US stocks), in terms of their earnings yield (the earnings per share divided by the stock price), shows stocks to be fairly valued:

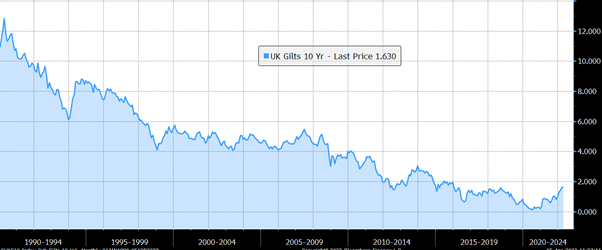

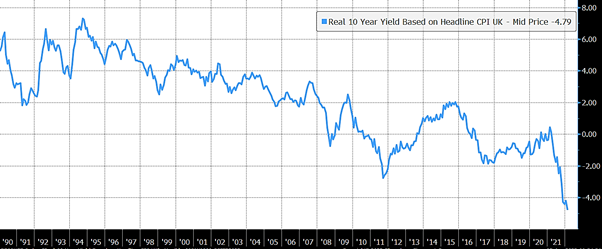

Of course, many will say (fairly) that whilst equities may look reasonable, bonds are still unattractive given both their low absolute yields, and even lower real yields:

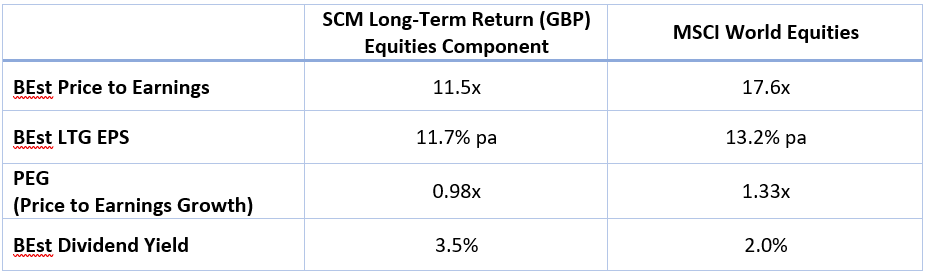

However, investors do not have to buy an index of world equities (dominated by expensive US tech stocks) or UK government bonds. There are plenty of different choices of mixed equity/bond funds/portfolios. For example, our SCM Long-Term Return Portfolio has its US equities exposure via a value-based strategy, a tilt towards small/mid-caps in Europe/Japan/emerging markets, resulting in a well-diversified portfolio of shares with slightly lower growth but with a significantly lower valuation. Growth is effectively being purchased on a 26% discount to a traditional market cap weighted index (based on the PEG ratio):

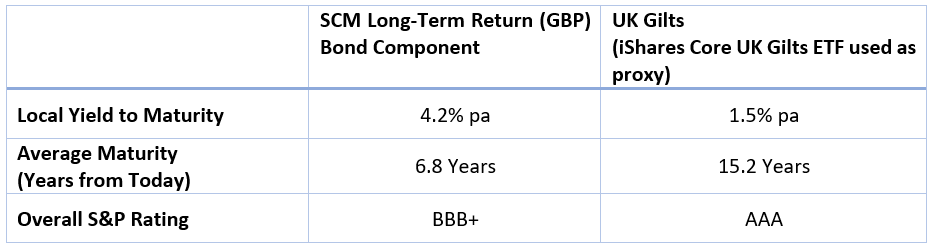

Similarly, investors do not have to buy UK government bonds. Within the SCM Long-Term Return Portfolio contains a combination of corporate bonds and non-western government bonds with the following characteristics:

In our view, starting from where we are today, a mixed portfolio of shares and bonds should outperform the average UK house price.

Much greater returns can be achieved by a diversified but more value orientated mix of bonds and equities. Not only are the returns likely to be better but the costs lower and the liquidity significantly.

Sources:

[1] https://www.comparemymove.com/advice/buying-a-home/cost-of-buying-a-house

[2] https://www.theadvisory.co.uk/house-selling/cost-of-selling-a-house/

[3] https://sevencapital.com/uk-property-investment/best-rental-yields-uk/

[6] https://www.santander.co.uk/personal/support/loans-and-mortgages/bank-of-england-base-rate-and-your-mortgage

[7] https://www.santander.co.uk/personal/mortgages/mortgage-calculators/mortgage-changes-calculator

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. SCM Private does not give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios please contact an independent financial adviser.

SCM Direct is a trading name of SCM Private LLP which is authorised and regulated by the Financial Conduct Authority to conduct investment business No. 497525.

SCM Private LLP is a limited liability partnership registered in England and Wales No. OC342778.