Scanning the papers, many commentators are starting to get nervous about inflation.

The Office for National Statistics (ONS) recently announced that the annual rate of inflation in the UK rose from 0.3% in November 2020 to 0.6% in December 2020[1]. Whilst the levels are still very low by historical standards, the recent pickup accompanied by the huge financial stimulus in the economy, have increased warnings from several quarters about the prospect of much higher inflation.

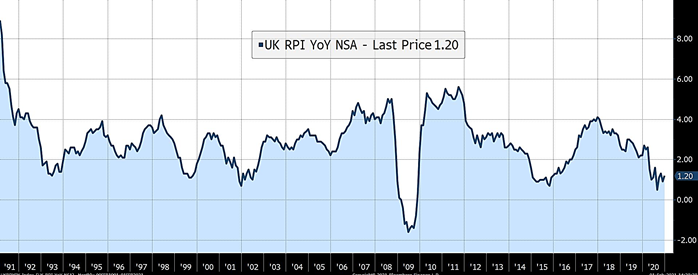

The current year on year inflation rate is 1.2% pa which remains low in comparison to the last 20 years:

The ONS blamed the pickup in inflation on increases in transport costs, computer games, games consoles and children’s toys offset by cheaper takeaway food and lower furniture and household equipment prices. So far in 2021, the price of Brent oil has risen by 11%, suggesting a continuing increase in headline numbers.

The question is, what do the markets believe will happen to inflation over the coming years? A statistic used by many is the “UK 10-year breakeven inflation rate” which measures the difference between the yield of a UK Government Bond with a maturity of 10 years to the equivalent Inflation-linked Bond. This shows, only a small uptick in inflation expectations over the next 10 years, averaging c. 3% p.a.

Where are We Today in Terms of the Income from Various Investments Against a 3% Inflation Expectation

- UK Bank/Building Society Accounts – even the best Bank/Building Society accounts do not offer interest of more than 0.5% p.a. [3] Currently the UK Bank of England Official Bank Rate is just 0.1% and this has been 0.5% or less since March 2009. So, savers who sit in cash are destined to see their savings fall in ‘real’ terms over the coming years.

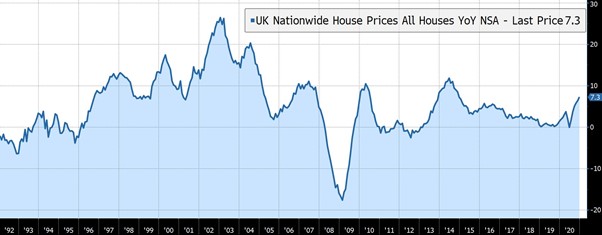

- UK House Prices – UK house prices have recently shot up fuelled by the stamp duty cuts but it is highly debatable, given the combination of higher unemployment, higher taxes, and higher interest rates, whether this growth can continue?

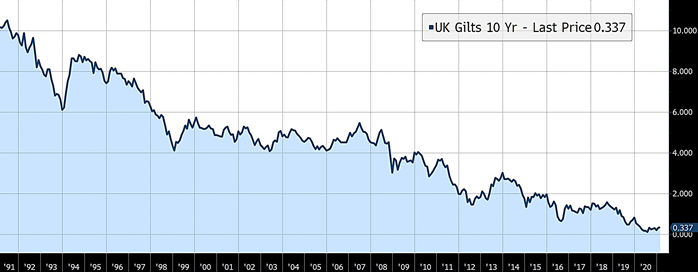

- UK Government Bonds – not much protection here. The yield on 10-year UK government bonds is just 0.3% pa so if the expectations of 3% inflation are correct, an investor buying these bonds is likely to lose about 2.7% p.a. in real terms i.e., 31% of their money over ten years in real terms.

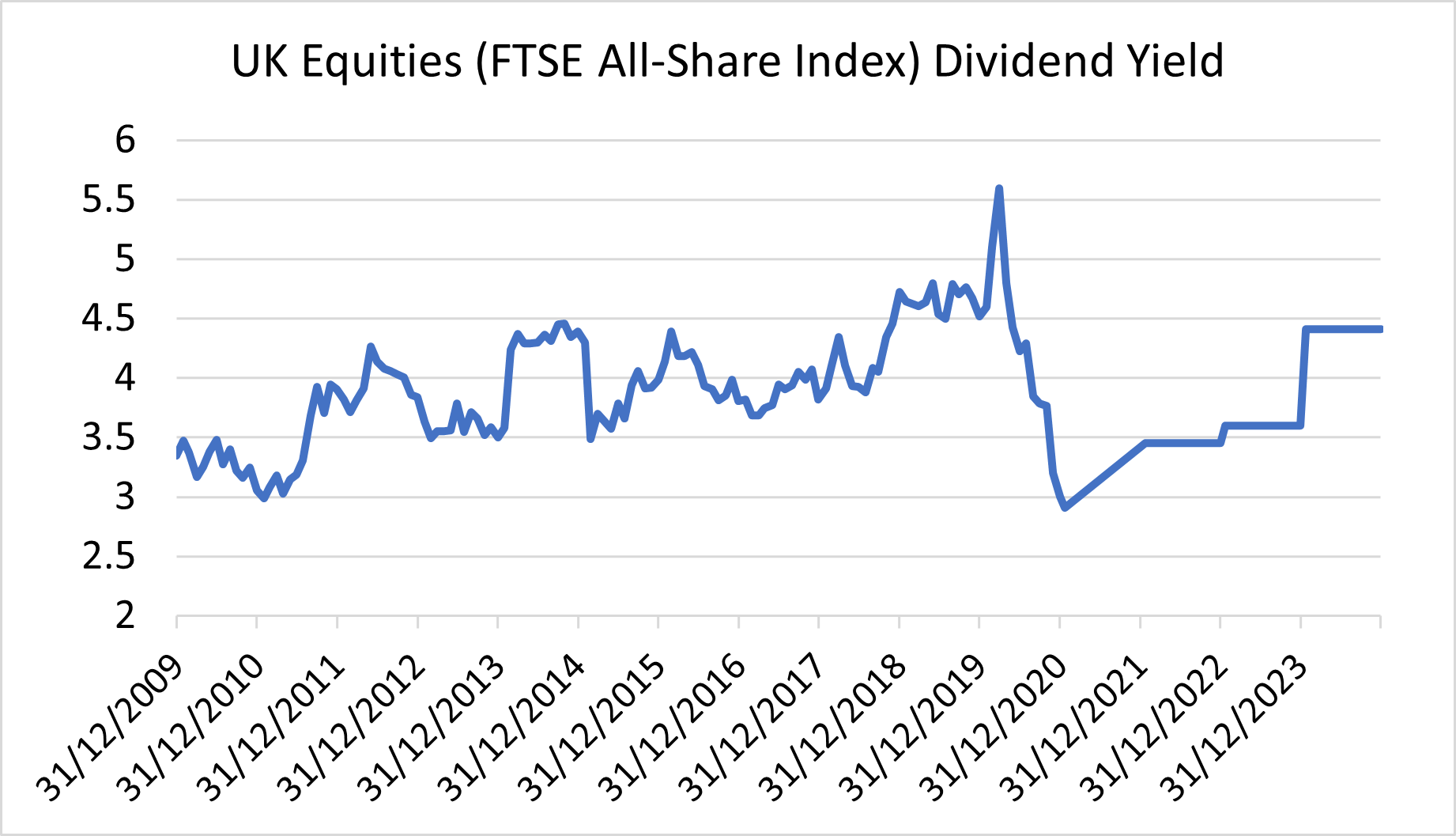

- UK Shares – whilst many of the largest dividend payers e.g., the large banks and oil companies, have slashed their dividends during the Covid epidemic, there is still an attractive 3.4% yield offered by UK shares at present and this is likely to rise as most banks restore their dividend

The Big Four banks (Lloyds, Barclays, NatWest and HSBC) all cancelled their dividends in 2020 after the Prudential Regulation Authority instructed them to set aside capital to support the UK economy. However, despite the uncertainty regarding the economic impact and loan losses, it is likely that these dividends will be gradually restored, resulting in the future yield from holding UK stocks rising to c. 4.5% p.a. over the coming years:

SCM Direct Analysis

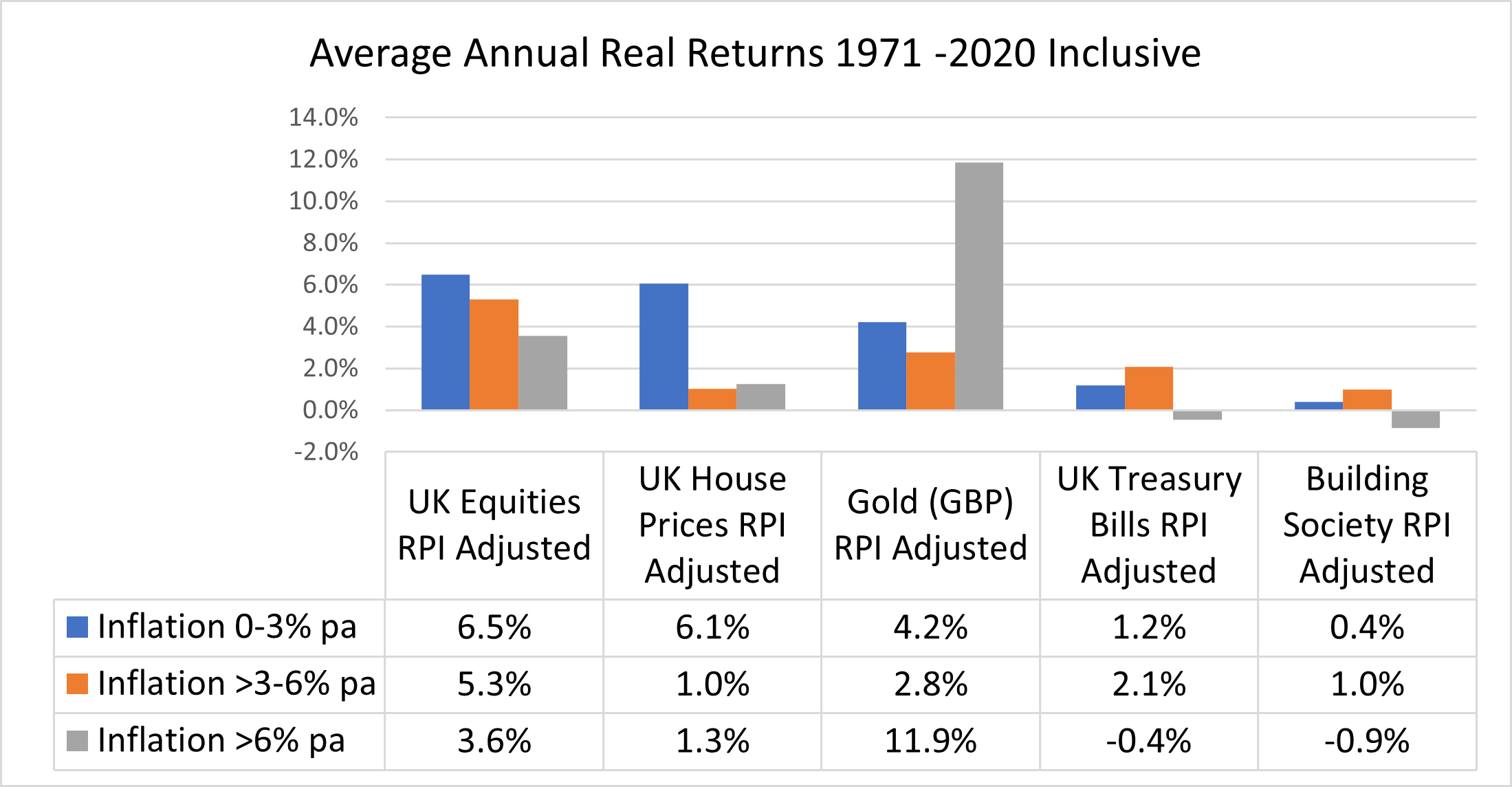

SCM Direct has analysed the average annual real returns i.e., the returns ahead of inflation[4], of UK Shares, UK Treasury Bills, UK Building Society Deposits, UK Property and Gold (in GBP) each calendar year from 1971 to the end of 2020 and found that UK shares were the only asset category that provided significant real returns whether inflation was less than 3% p.a., 3 to 6% p.a. or more than 6% p.a. – super real returns from gold were normally only associated with high inflation.

Is this likely to be a good guide to the future?

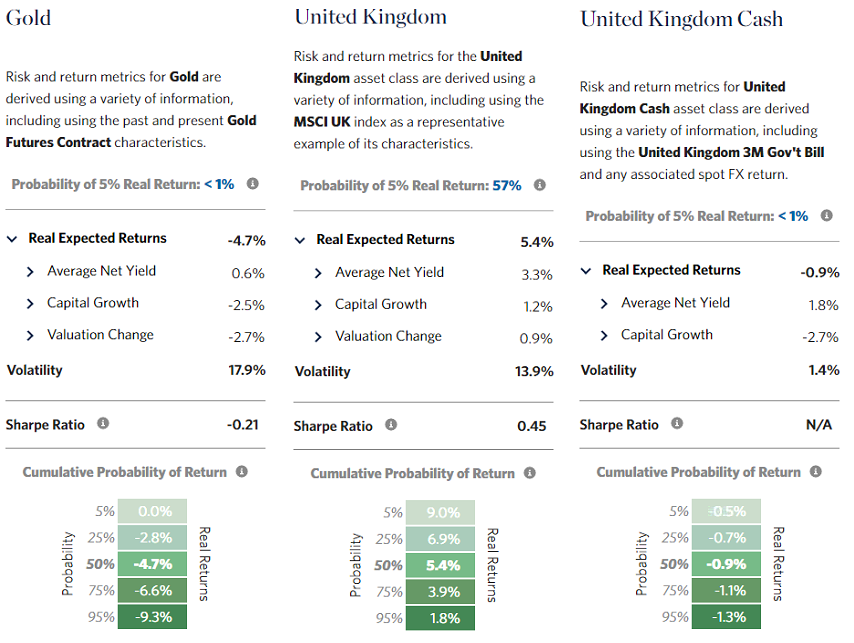

Research Affiliates[5] have crunched through their asset allocation model, and based on a UK expected inflation rate of 2.7% pa, they forecast UK Shares to produce a real return of 5.4% pa whilst UK 3m Treasury Bills are forecast to earn much lower real returns of -0.9% pa and gold -4.7% pa.

[2] https://www.ons.gov.uk/economy/inflationandpriceindices

[3] https://www.moneysupermarket.com/savings/

[4] Annual Real Returns formula: (1+nominal return)/(1+inflation)-1, Inflation: UK RPI All Items Index, UK Equities data: FTSE All-Share Index, UK House Prices data: seasonally adjusted UK Nationwide House prices Index, Gold prices: LBMA Gold Price PM in GBP, UK Treasury Bills: Barclays UK Treasury Bill Index, Building Society: Barclays Building Society Fund until 2016, Halifax Liquid Gold thereafter.

[5] https://interactive.researchaffiliates.com/

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.