Since the start of the Coronavirus pandemic, there has been growing talk about new norms. These discussions have not eluded the investment management industry, but increased the already heightening interest and trend towards Environmental, Social and Governance (ESG) / ethical investing; as more and more people are becoming conscious about issues around resilience and sustainability. Trends towards ESG investing are said to be the catalyst that will shift company and investor behaviour.

Across Europe sustainable funds saw inflows of €30bn in the first quarter of 2020 against a backdrop of some of the worst stock market falls in history which saw €148bn withdrawn from funds overall across Europe. In the first quarter of 2020, we witnessed a very rapid bear market (a 20% or greater fall) with the MSCI World Index in US$ falling by 26% from its 19th February high to its 23rd March 2020 low. Then experiencing a rapid bull market (a 20% or greater rise) with a 20.1% rise from it’s low to the 29th April 2020.

In November 2019 we were tracking the trend to ESG investments and became concerned about the growing myth that all ESG funds were ‘good funds’ and that few people were looking under the bonnet, conducting robust levels of due diligence as they should with all funds. This led us to research and publish a report ‘Greenwashing: Misclassification and Mis-selling of Ethical Investments’ that highlighted several of the key failings currently residing in ethical investing, as well as analysing active and passive performances against a comparable market cap index. In our report, the SCM Direct Investment Team noted “that the average Equity mutual fund underperformed the market by 2.5% per annum over the three years to end June 2019, compared to 0.8% per annum for the average passive ethical equities fund.”

Given the fact that 2020 has witnessed both a bear and bull market in just four months, our recent analysis interrogated how ethical funds performed over both the highs and lows during early 2020. We analysed performance from the end of 2019 to the 23rd March 2020 low point, and then from this low point to the end of the April 2020. We used the MSCI World Index to select the low point (23rd March 2020). Several of the funds have ceased trading since the original report, reducing the number of ethical mutual funds screened to 490, with a combined total asset of $163bn, together with 53 Ethical ETFs with combined total assets of $40bn.

Only primary share classes were selected whilst funds that had no comparable market cap index (such as Gender equality funds) were removed. The closest available MSCI Index was used as a market cap proxy, except in the following:

- US Small Cap – Russel 2000 Index used

- US Mid Cap – Russel Mid Cap Index used

- US Large Cap – S&P 500 Index used

- US Broad – Russel 3000 Index used

- UK Broad Market – FTSE UK All Share Index used

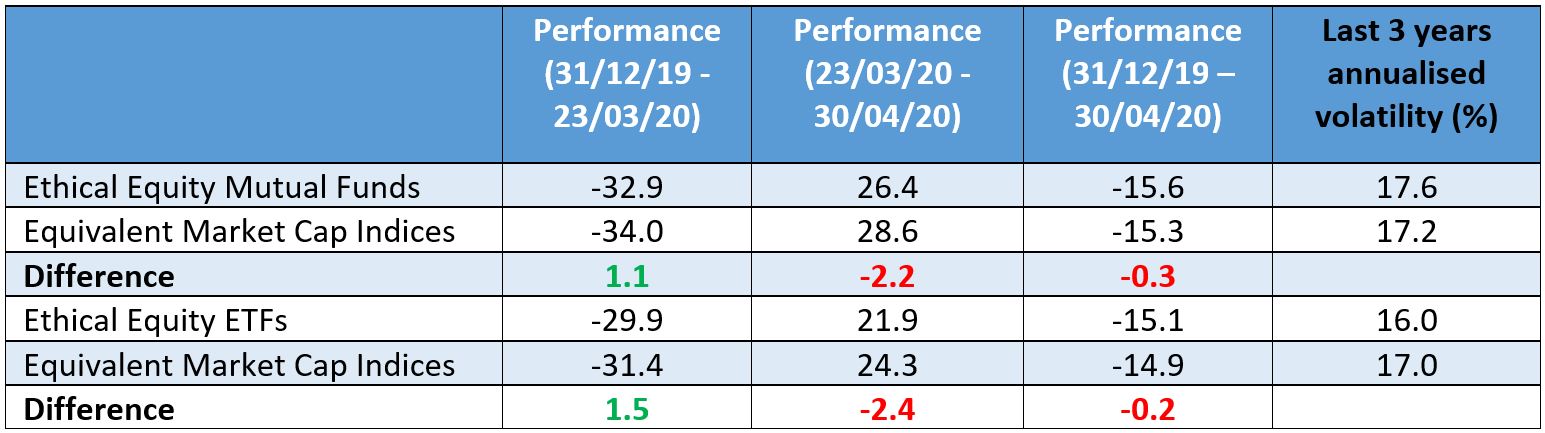

SCM Direct found that the average Ethical Equity mutual fund outperformed the traditional market cap benchmark by 1.1% during the market collapse (31/12/19 – 23/03/20) BUT, the average ethical index fund, outperformed even more, by 1.5%.

However, this performance was reversed during the subsequent market rally (23/03/20 – 30/04/20) with the average Ethical Equity mutual fund under-performing the traditional market cap benchmark by 2.2% and the average ethical index fund, under-performing slightly more, by 2.4%.

Taking the two periods together, i.e. from 31/12/19 – 30/04/20, the performance was very similar – the average Ethical Equity mutual fund under-performed the traditional market cap benchmark by 0.3% and the average ethical index fund under-performed by 0.2%.

In addition, despite the very similar performance overall, the average Total Expense Ratio of the ethical ETFs was less than a quarter of the amount charged by the active ethical funds – 0.32% vs 1.34% pa.

The ethical ETFs were also less volatile – as measured by the standard deviation of returns, which may be due to their greater diversification.

The research found that whilst the longer term attractions of ethical investing, particularly via low cost, better spread, index funds are known, 2020 has also shown that such funds tend to be slightly “defensive” in style, allowing them to outperform in bear markets but then under-perform in the recovery.

Unfortunately, in investment like many things, there are very few free lunches.

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. Exchange rates may cause the value of overseas investments and the income arising from them to rise or fall.

SCM Direct is a trading name of SCM Private LLP which is authorised and regulated by the Financial Conduct Authority to conduct investment business no 497525. Registered in England and Wales, OC342778.