It is easy to be very depressed about the prospects for investing faced with the uncertainly and economic fallout of the Russia / Ukraine crisis – the unknown unknowns. We used to hold Russian equities directly via a Russian equities ETF but sold these in June 2019 when they were in vogue – see From Russia With Love – SCM Direct.

Here is some of the bad news being widely discussed following Russia’s invasion of Ukraine on 24 February 2022.

- The war does not appear to be following the pattern predicted by military and political experts, prior to the invasion. On 11 February Sky News reported that ‘The Russian military could reach the Ukrainian capital of Kyiv within 48 hours, a US intelligence report reveals.’

- Many economies are dependent on Russia for oil & gas – it’s easier for the US to stop Russian oil imports when it accounts for 7 to 8% compared to 30% in Germany. Germany gets 55% of its gas from Russia.

- Many countries and consumers are dependent on Ukraine for key commodities and as such prices have spiked upwards e.g., wheat and nickel, oil and natural gas, and even fertiliser.

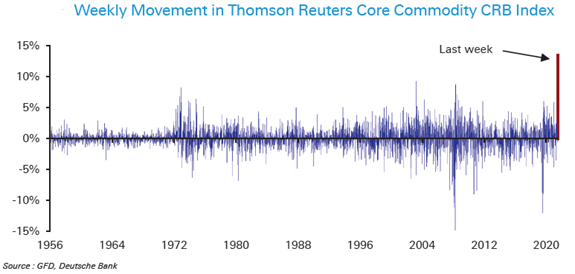

The movements in commodity prices are almost unprecedented, as this chart from Deutsche Bank of last week’s movement in commodity prices shows:

No doubt countless professional investors will now launch or invest in commodity funds for client portfolios, but it’s almost certainly too late. Over the long term, returns are normally dire, characterised by sharp spikes, then long declines.

According to Deutsche Bank, in the 150 years up to summer 2021, the real return of oil, wheat, and copper was -0.42%, -1.12% and -0.56% respectively per annum. The US equities index, the S&P 500 rose by +6.57% p.a. over the same period (including dividends).

It is also well known, and hardly surprising that the spike in these key commodities will further increase inflation. However, it is interesting to note that the oil price has fallen today following the US announcement. Looking at the prices implied by oil futures currently (orange line) and a month ago (green line), we can see that markets are not expecting the current oil prices to last long:

However, it is true that UK and US inflation expectations over the next 5 years have now moved further upwards – to 5 and 3.4% per annum respectively:

At times of crisis, like now, investors tend to be either glass full or glass empty with no middle ground. The markets don’t like uncertainty and they tend to overprice risks, particularly hard to compute risks e.g., the current geopolitical one.

That often means at times like this if you can stomach the volatility, it is likely you will come out ahead as the odds are now stacked in your favour. When investors are scared or not willing to take on risk (often fairly), the prices will naturally fall together with valuations. Eventually normality returns and those that took advantage of fear will often (not always) make money.

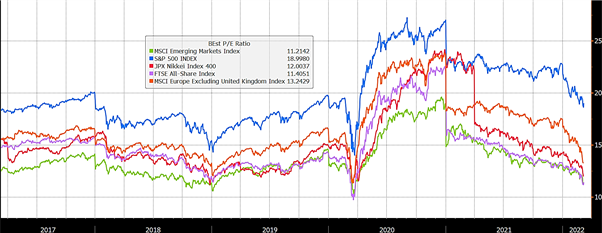

Today, emerging market equities, UK equities and Japanese equities are close to 5-year lows on valuation:

The (potential) good news is that when investors are most fearful and thereby prices and valuations low, is when investors tend to make the best returns.

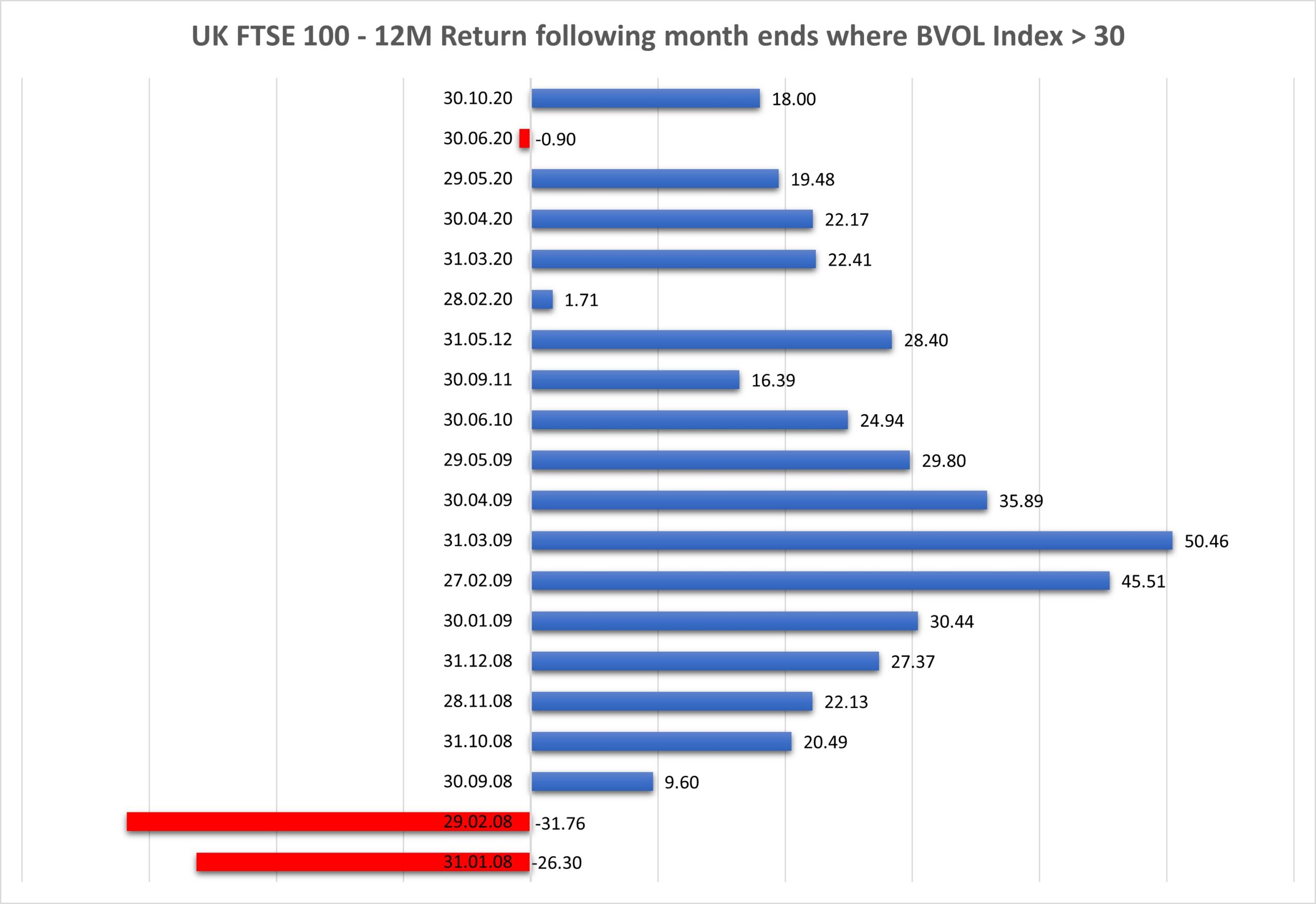

The UK market has an annualised return for the blue-chip FTSE 100 of 5.5% per annum over the period 31.01.06 to 28.02.22. However, our analysis shows that the average return from investing for 12 months in the FTSE 100 at times of elevated volatility was 3.3x at 18.3% on average (based on investing when the monthly UK 3m volatility index was 30 or above).

The golden rules of investing still apply at times of uncertainty:

- Diversification to reduce risk

- Low fees matter

- Real returns matter

- Fundamental value matters

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.