When it comes to ESG funds – Environmental, Social and (corporate) Governance, it is hard to be shocked by the brazen product sleight of hand of some fund management companies, who are dressing up funds in an ESG cloak, covering up that there is really very little difference to their traditional, non ESG funds.

We were recently quoted in the media saying that the L&G ESG China CNY Bond ETF ‘is the most flagrant example of greenwashing’ in the UK.

Below are the reasons why we believe L&G are brazenly greenwashing and misleading investors:

- The L&G fund ‘aims to provide exposure to the government and policy bank bond market in China’ – how can this ever be a candidate for inclusion in an ESG fund in the first place? When funds invest in companies, using a ESG methodology, they often use the UN Global Compact which asks companies to embrace, support and enact, within their sphere of influence, a set of core values in the areas of human rights, labour standards, the environment, and anti-corruption. I would argue that the same principles should be applied to bonds as shares. These core values make up the Ten Principles of the UNGC, many of which appear to be highly questionable as regards the Chinese Government, and with China reported to be the world’s biggest polluter:

Human Rights Principles

-

- Principle 1: businesses should support and respect the protection of internationally proclaimed human rights; and

- Principle 2: make sure that they are not complicit in human rights abuses.

Labour Standards

-

- Principle 3: businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining.

- Principle 4: the elimination of all forms of forced and compulsory labour.

- Principle 5: the effective abolition of child labour; and

- Principle 6: the elimination of discrimination in respect of employment and occupation.

Environment

-

- Principle 7: businesses should support a precautionary approach to environmental challenges.

- Principle 8: undertake initiatives to promote greater environmental responsibility; and

- Principle 9: encourage the development and diffusion of environmentally friendly technologies.

Anti-Corruption

-

- Principle 10: businesses should work against all forms of corruption, including extortion and bribery.

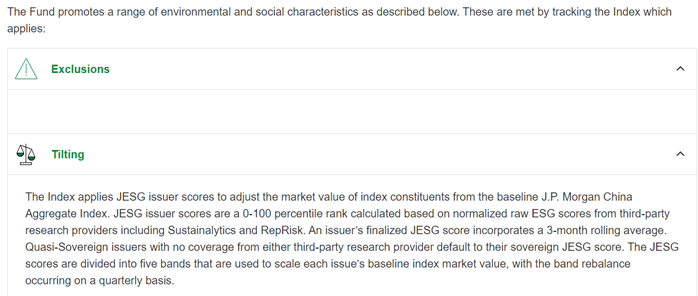

- The L&G ESG China CNY Bond UCITS ETF claims that ‘The Fund promotes a range of environmental and social characteristics which are met by tracking the Index’ but it transpires this index has no exclusions whatsoever but somehow ‘adjust the market value of index constituents from the baseline J.P. Morgan China Aggregate Index.’

This tilting seems in practise highly dubious as the L&G ESG China CNY Bond ETF holds the exact same four China Government/Quasi-Government issuers as a typical non-ESG China Government Bond ETF – being bonds issued by the Government of China, China Development Bank, Agricultural Development Bank of China, and the Export-Import Bank of China.

What fundamental ESG difference does it make anyway if you simply tilt between four different issuers of bonds, all of which are 100% Chinese Government-owned?

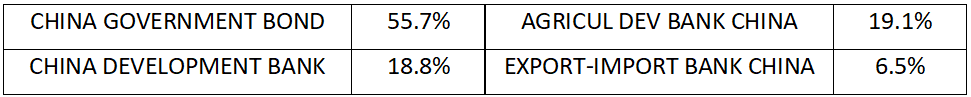

The current weightings of the index to these four issuers is as follows:

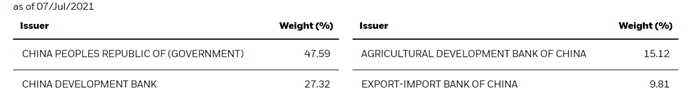

This is very similar to the weightings in the exact same four issuers as a non-ESG China Government Bond fund e.g., the iShares China CNY Bond UCITS ETF:

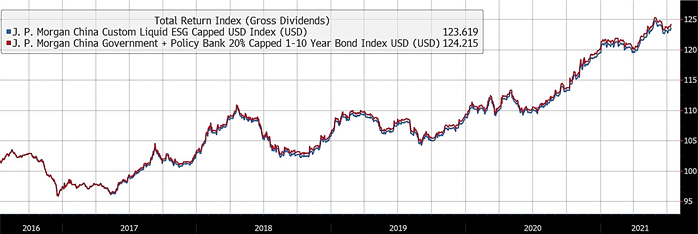

- It is no wonder then, that when we look at the index used by the L&G ESG China CNY Bond fund and compare this with a non-ESG Chinese Government Bond index over 5 years, they have virtually identical performance – the difference is just 0.1% pa.

How to clean up this greenwashing, in our view:

-

- L&G should immediately remove the ESG label/name from this fund name and literature as it is clearly misleading to purport to investors/clients that this fund has any credible ESG credentials.

-

- The FCA should urgently review the evidence within this blog and if appropriate, fine L&G for mis-selling, and publicise as a deterrent to others pursuing blatant greenwashing. This anti-consumer, misleading practice in the fast-growing ESG investing sector is scandalous and in our view occurring on an industrial scale in the UK. The FCA has publicly defined greenwashing as “marketing that portrays an organisation’s products, activities or policies as producing positive environmental outcomes when this is not the case”. It appears that L&G have been unable to defend this fund, saying that “L&G wouldn’t comment on the record as to why it uses an ESG label on this fund”.

-

- The L&G Board must review its procedures and processes that allowed this fund to ever be launched in the first place. There is nothing wrong in offering investors exposure to Chinese Government Bonds (we believe these are very attractively priced at present), but please do not pretend such bonds should be included in an ESG fund.

-

- The L&G Board should not award any ESG related bonuses as ‘From 2021, an ESG measure will become part of the annual bonus performance conditions for executive directors. This was included in the new remuneration policy which shareholders approved in 2019.’ It is pure hypocrisy for L&G to claim greenwashing “will be one of the biggest challenges to asset managers in 2020″.

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.