Introduction:

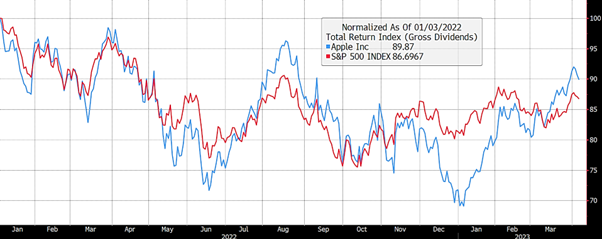

As we enter the second quarter of 2023, the technology sector has seen substantial gains, with companies like Apple leading the charge. As the chart below shows, the performance of Apple and the wider US market seem to go hand in hand with Apple now more than fully recovering its lost ground against the wider market. Apple is the largest stock in the S&P 500, currently accounting for 6.6% of the market – the next largest stocks are all tech related – Microsoft (5.6%), amazon (2.5%), Nvidia (1.7%). At one point last year, Apple was more than 30% down from the start of the year, now it’s just 10% down.

However, at SCM Direct, we believe that some of these tech stocks are now reaching rich valuations, which could impact the performance of both the NASDAQ and the S&P 500. Investors seeking better value may want to start exploring opportunities in other markets. In this blog, we will delve into the factors driving these valuations, Apple’s projected earnings growth, and suggest potential alternatives for your investment portfolio.

Apple and the Tech Sector’s Rise:

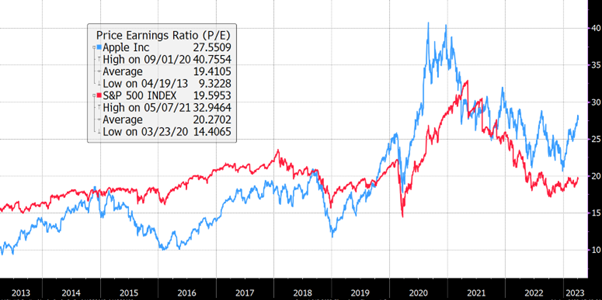

Apple Inc. (AAPL), the tech giant known for its innovative products, has experienced impressive growth in 2023, pushing its market capitalization to new heights. As of April 2023, Apple boasts a P/E ratio of approximately 28x, significantly above its 10-year historical average of around 19x.

Several factors have contributed to this rise, including strong demand for consumer electronics, the transition to remote work, and continued expansion in cloud computing and artificial intelligence. While these factors have certainly fuelled the growth of tech companies, the resulting valuations are now raising concerns among some investors.

Projected Earnings Growth and Apple’s Transition:

Looking forward, analysts project Apple’s earnings growth to slow down, with a 5-year compound annual growth rate (CAGR) of around 7%. This is considerably lower than the double-digit growth rates the company experienced in the past.

Interestingly, more recently the earnings growth projections have been gradually coming down (red line) but this has not stopped the shares rising (white line):

This slowdown in growth could be attributed to market saturation in the smartphone industry and increased competition from other tech giants. The global smartphone market is expected to grow at a CAGR of just 2.6% from 2023 to 2026, reaching 1.53 billion units in 2026, driven by the increasing adoption of 5G smartphones, the growing popularity of foldable smartphones, and the expansion of smartphone penetration in emerging markets. However, Apple’s market share is expected to decline from 20% in 2023 to 16% in 2026, as competition from other vendors intensifies.

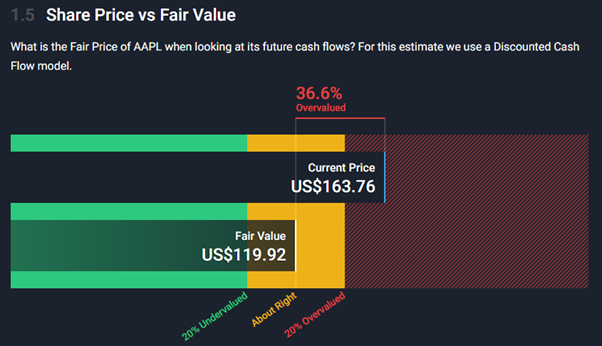

As a result, Apple might be transitioning from a growth stock to a cash cow, given its robust cash flows and ability to generate substantial profits. However, cash cows tend to have lower valuations than growth stocks. Of course, Apple operates a fantastic business, but the question remains is it already (more than) discounted by its share price. One valuation model that is often interesting is that provided by the analytics company, Simply Wall St. It’s valuation is based on a discounted cash flow model, which considers a company’s future cash flows and discounts them back to the present value using a discount rate. Simply Wall St uses a discount rate of 9.2%, which is based on the company’s risk profile and calculates Apple’s share price as being 26.6% above it’s fair value:

Finding Better Value in Other Markets:

Considering the rich valuations of tech stocks, investors may want to consider opportunities in other markets where better value can be found. Here are some suggestions:

1.Emerging Markets: Countries like India, China, and Brazil have experienced strong economic growth and offer exposure to various industries beyond technology. While these markets come with risks, they can provide diversification and potential upside for investors. Whilst many of these markets, particularly China had a bounce after China abandoned its zero covid strategy, they have still underperformed the US market by c. 43% since 2018:

SCM Direct invests in a large cap Emerging Markets ETF and a small cap/high dividend Emerging Markets ETF – the P/E multiple of their underlying holdings are just 10.9x and 7.7x respectively.

2. Small and Mid-Cap Stocks: Investors looking for value might consider small and mid-cap stocks, which have lagged behind large-cap tech stocks in recent years. These companies may be less well-known but offer growth potential and attractive valuations. SCM Direct invests in smaller and mid-cap ETFs investing in Europe, Emerging markets and Japan.

3. Value-Oriented Sectors: Certain sectors, such as financials, industrials, and consumer staples, have not experienced the same run-up in valuations as tech stocks. Investors seeking value may find opportunities in these more traditional sectors. SCM Direct invests in a US equities value orientated ETF whose underlying holdings are valued at just 12.9x vs 18.1x for a traditional S&P 500 ETF.

4. Dividend-Paying Stocks: With interest rates remaining low, dividend-paying stocks can offer an attractive alternative for income-seeking investors. These stocks often come from more stable sectors and can provide a cushion in times of market volatility. Of course, one of the markets that is made up by such higher dividend payers is the FTSE 100 where the dividend yield is currently 4.2% per annum. SCM Direct invests in various UK large cap and mid cap equities ETFs.

Final Thoughts:

As the tech sector continues to dominate headlines, it’s vital for investors to maintain a diversified portfolio to manage risk effectively. By allocating investments across various sectors, industries, and asset classes, you can mitigate the potential negative impact of a downturn in any single area. The rich valuations of tech stocks, including Apple, serve as a reminder that no sector is immune to market fluctuations.

Investors seeking better value may find it beneficial to explore other markets and diversify their portfolios beyond the NASDAQ and the S&P 500.

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. SCM Private does not give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios, please contact an independent financial adviser.

SCM Direct is a trading name of SCM Private LLP which is authorised and regulated by the Financial Conduct Authority to conduct investment business No. 497525.

SCM Private LLP is a limited liability partnership registered in England and Wales. No. OC342778