There is a phenomenon in psychology called the availability heuristic where people make judgements about the likelihood of an event based on how easily they recall an example, instance, or occurrence. The UK stock market has been one of the worst-performing major markets so far in 2020 and in recent years has underperformed most major markets, particularly the US market.

Recent data shows that UK equity funds account for just 14% of the total funds held by British investors this year, versus 39% in 2004, 15 years ago.[1] The Investment Association who compiled this statistic blames this on UK investors losing confidence in their home market.

I wonder how much of this UK pessimism by fund managers and investors alike is due to the availability heuristic bias? Many will know that the FTSE 100 is close to 6,000 and has been close to 6,000 for many years, but it is a ‘lazy’ number, shown everywhere because it is easy to remember, or is it a true reflection?

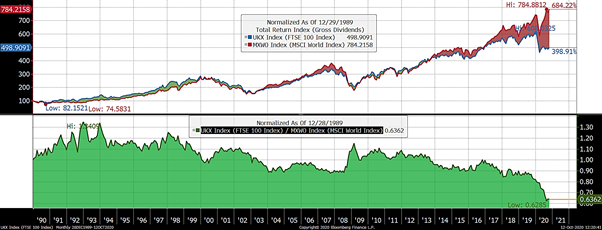

As the chart below shows, the FTSE 100 is 13% lower today than it was just after 2000. Of course, the headline number for the index excludes the dividends paid out these UK blue chips over the years – when you add in this income the return from the end of 1999 to the end of last week was actually +82%.

Furthermore, we are also reminded constantly about the success of great US tech stocks e.g. Apple, Amazon, Tesla, Google etc which have powered the US market and has left the UK behind. However, this phenomenon again is relatively recent.

The chart below shows the performance (with dividends) in local currency of the UK FTSE 100 (blue line) versus the MSCI World Equity Index (red line). You can see from the ratio in the green chart, the second of the two charts, that from 2004 to 2017, the UK performed closely to its global peers, but from 2017 onwards has dramatically underperformed.

Have investors again based their decisions on the last 3.5 years and ignored the previous 13 years?

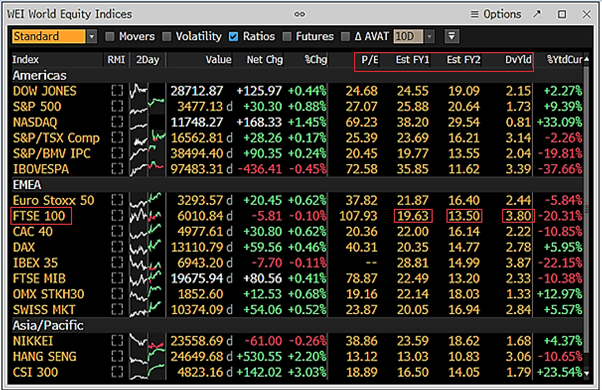

The UK stock market, based on consensus estimates is now one of the lowest valued markets in the world – it is the second-highest yielding and lowest-rated major markets in the world (only Hong Kong and Spain are similar/less highly valued):

Some of the reasons for the UK discount factor cited are the uncertainty regarding a UK/EU trade deal, coronavirus, low exposure to tech/high growth stocks amongst other reasons. In fact, looking at the S&P 500 Index, the most commonly cited US index, the return this year (in US$) has been +9.2% but excluding IT stocks it is just +0.5% – although still much better than the FTSE 100 total return of -18%.

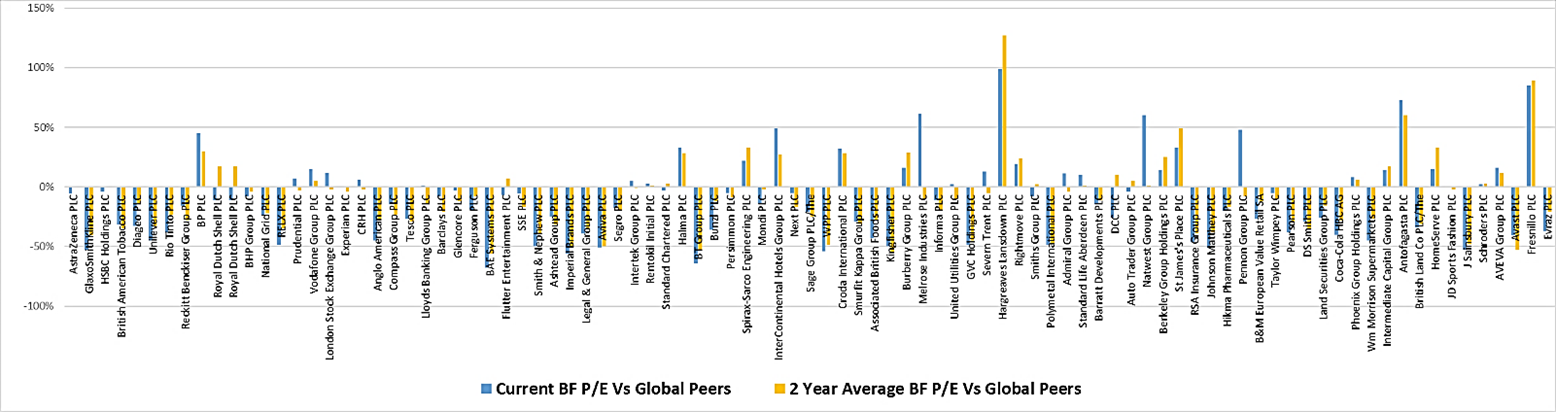

We thought the fairest way to measure the UK discount is to look at all the individual stocks with available data in the FTSE 100 (this amounted to 96% of the FTSE 100 by value) and then compare their current forward Price-Earnings ratio against their global stocks in their particular sub-industry now, as compared against two years ago. We then weighted the results by market cap to ensure we represented the FTSE 100 as closely as possible. For example, Astra Zeneca was compared with Glaxo, Novartis, Sanofi, Novo Nordisk, Merck, Eli Lilly, Pfizer, Bayer etc.

This we believe was a way of comparing like with like, to test whether there really was any form of UK discount that was not accounted for by the types of stocks prevalent in the UK stock market.

The result was probably not surprising but nevertheless interesting. The weighted average discount of a UK FTSE 100 stock is currently about 15% to its global peers. This discount has widened recently, with the average discount over the last two years being closer to 12%.

The question therefore is, are there factors that would lead to this discount closing? The answer is yes, there are several potential catalysts:

- The specific stocks and industries that dominate the FTSE 100 become slightly less unfashionable as US and European Governments start to focus on some of the global tech names for closer scrutiny

- US corporates face higher tax rates as a potential Biden Government reverses some of the Trump tax cuts

- and some form of UK/EU deal is finalised reducing UK related uncertainty.

The best predictor of future performance tends to be valuation (maybe one for Tesla investors to consider). When valuations are low, future returns tend to be high and visa versa. Rather than give up on the UK stock market, its current valuation whether looked at in absolute terms or in relative terms, looks anonymously low. Therein lies an opportunity.

[1] https://citywire.co.uk/funds-insider/news/brits-shun-uk-shares-as-fund-allocations-hit-record-low/a1405221

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.