A wealthy man once wrote: ‘there is a time and season for everything under the sun’. Solomon also diversified his famous net worth across multiple sectors, including commodities and transportation. Several millennia later, the demand for gold and silver remains solid, while disruptive new entrants have overtaken the chariot trade.

August is typically a time of thin and fickle volumes across most asset classes, as investor trade their trading terminals for airport terminals and more relaxing views. We were curious to see if there were any trends during this period and if it is possible for investors to take advantage of any monthly trends identified.

Some believe in the September Effect, when prices come under pressure from post-holiday pessimism, while others anticipate a January Effect, when markets can be fueled by evergreen optimism for the year ahead. In terms of cataclysmic changes in valuation, October has experienced an unusual number of market shocks. In 1987, the Dow Jones plummeted over 20% on Black Monday, preceded by the Panic of 1907 and the Great Crash of 1929, which resounded across the political and economic structures of the twentieth century.

So, what insights into the reliability of these behavioural trends can be gleaned from the last 20 years of IA sector data during August, compared to ‘effect’ months?

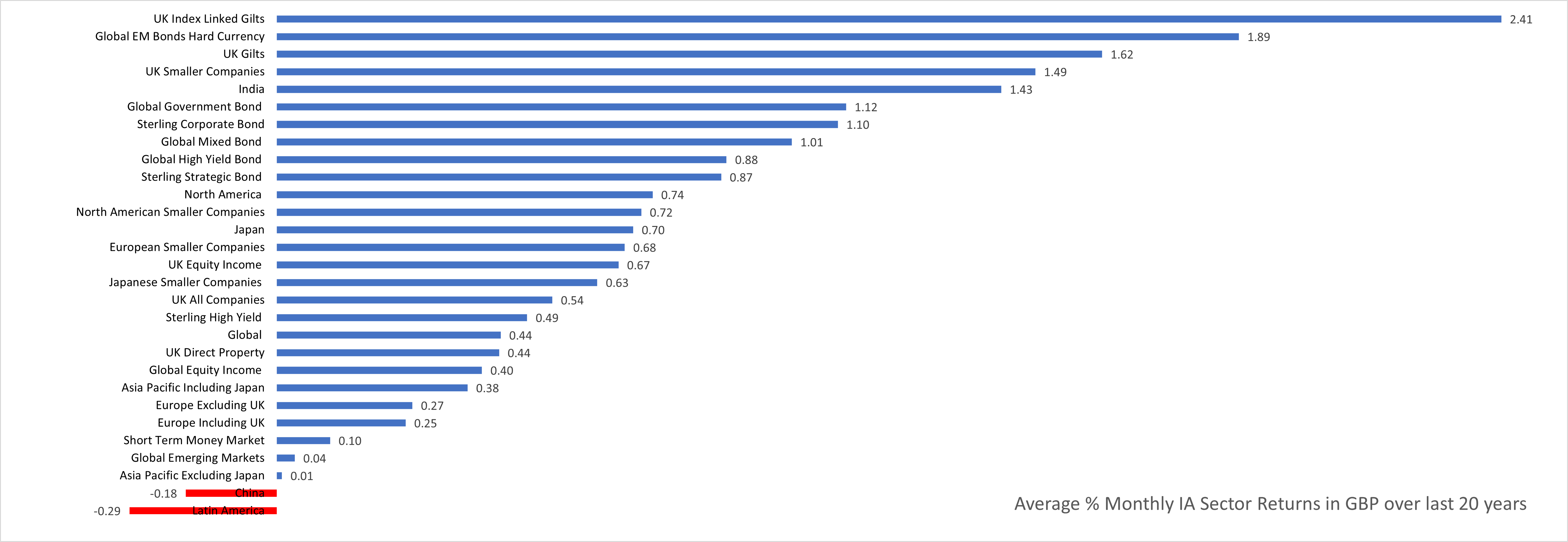

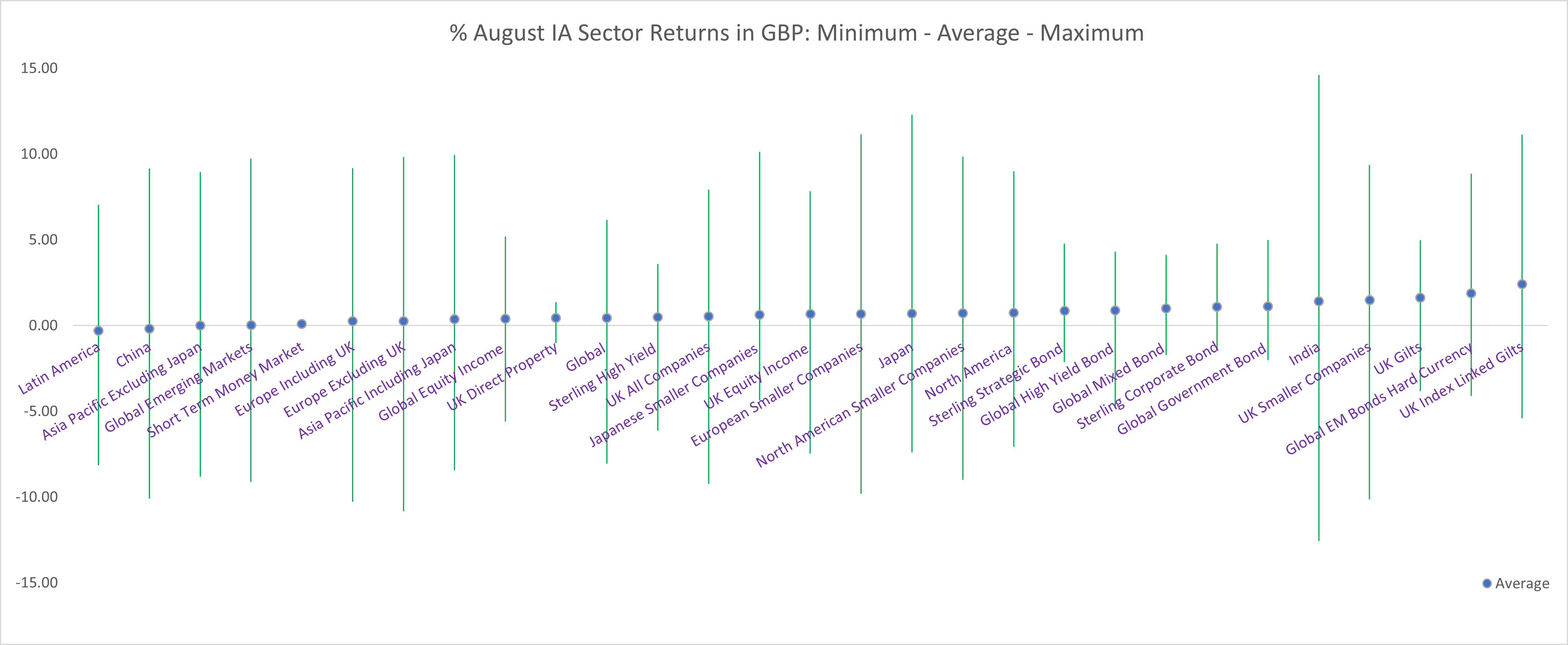

The average returns for August suggest Index-Linked Gilts (+2.4%) and Gilts (+1.6%) could be compelling, while Global Emerging Markets (0.0%) and China (-0.2%) might be worth avoiding. From this perspective, de-risking portfolios might be the optimal strategy.

However, in August 2020 Index-Linked Gilts fell 5.4%, and Global Emerging Markets rose 9.8% in August 2003 – demonstrating that contrarian thinking versus conventional wisdom has the potential to pay off handsomely.

At the same time, average returns can obscure a wide range of individual monthly results. For example, August performance for UK Index-Linked peaked at 11.1% in 2016, a 16% spread over the 2020 result.

Is there evidence for a September effect? During this month, Global Government Bonds (+0.4%) delivered one of the strongest returns over the last two decades, while North America (-0.5%) was the weakest sector on average. This could provide impetus to dial down risk in the autumn. However, Global Government Bonds fell 3.0% in September 2017 and North America rose 6.5% in September 2010.

What about the January Effect? UK Smaller Companies (+0.9%) offered the best average returns, while Europe ex UK (-0.9%) was the leading laggard. On the other hand, UK Smaller Companies fell 8.2% in January 2008, and Europe ex UK rose 10.0% in September 2010.

For October, although the downside has been historically severe on occasion, the typical ‘risk-on’ sectors of Latin America (+2.6%) and China (+2.1%) have offered the most attractive returns, with ‘risk-off’ exposures to Gilts (-0.5%) and Index-Linked Gilts (-0.5%) suffering.

In conclusion, relying on monthly patterns can be painful when historic patterns no longer repeat or fail even to rhyme as Mark Twain once suggested.

SCM positions our clients’ wealth for resilience to market volatility by diversification across the most attractive asset classes on a risk-adjusted basis – every month.

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. SCM Private does not give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios please contact an independent financial adviser.

SCM Direct is a trading name of SCM Private LLP which is authorised and regulated by the Financial Conduct Authority to conduct investment business No. 497525.

SCM Private LLP is a limited liability partnership registered in England and Wales No. OC342778.