On the 14 January this year, we posed the question: How far can you stretch an elastic band before it snaps?

I wrote at the time:

‘Our view is that many of the large US stocks which have driven the US performance are now massively over-extended, like an elastic band, and whilst we cannot predict when this band will snap, it seems inevitable it will at some point soon. In some cases, for example Tesla, the values are bordering on a complete bubble.

Any investor thinking that buying a global equities index fund gives them good diversification is fooling themselves. For example, the MSCI World Index is now 72% US and dominated by a handful of US tech stocks – Nvidia, Apple, Microsoft, Meta, Tesla and Alphabet represent about 24% of the index!’

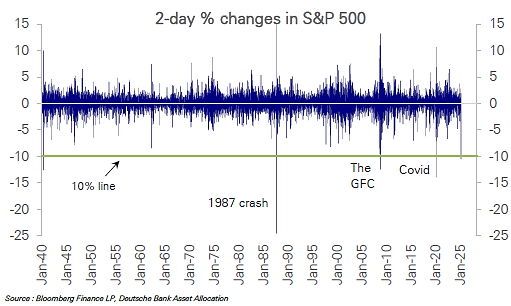

The recent weeks have provided a stark answer. Due to President Trump’s ‘Liberation Day’ tariff announcements, markets have experienced significant volatility. The S&P 500 recorded a historic two-day decline of 10.5%, a drop rarely seen since World War II. Since our last blog Tesla has fallen 41%, the Magnificent 7 stocks 23% and the S&P 500 13%.

The below chart details the S&P 500’s Historic Two-Day Declines, which shows the magnitude of recent drops compared to historical events in 1987, 2008, and 2020.

What Have SCM Direct Been Doing Differently?

At SCM Direct, while we have not made sweeping changes to our asset allocations, we’ve taken proactive steps:

- Increased Exposure to UK and US Government Bonds:

Earlier this year, we capitalised on market movements to further bolster our holdings in government bonds, providing stability amid equity market turbulence. - Considering Rotation from US Treasuries to UK Gilts:

With current market conditions, we’re evaluating shifting from US Treasuries to UK Gilts to optimise returns and manage risks effectively. - Monitoring Japanese Equities:

The recent tariff induced sell-off has impacted Japanese stocks significantly, presenting potential value opportunities that we are watching very closely.

Our equity portfolios have maintained minimal exposure to US mega-cap stocks, particularly the “Magnificent 7,” aligning with our value-based investment approach.

As of 7 April 2025, even after the recent falls, the US market represents 69% of the value of the world equity markets, and the Magnificent 7 stocks still account for 20% of the world equity markets.

Emerging Investment Themes

In the evolving landscape marked by tariff uncertainties and economic fragmentation, certain investment themes are coming to the forefront:

- Domestic Resilience:

Companies with strong local market foundations are better positioned to navigate global disruptions. - Defence and Infrastructure:

Sectors focusing on national security and infrastructure development are gaining prominence. - Dividend Sustainability:

Firms with a consistent history of dividend payouts offer attractive prospects for income-focused investors.

Conversely, the previous unwavering confidence in major tech giants is undergoing re-evaluated, highlighting what we have always been alert to – the risks of concentrated investments.

Magnificent Seven: Opportunity or Risk?

The “Magnificent 7” stocks still constitute over 20% of the MSCI World Index, leading to continuing concerns about over-valuation and concentration risk. Many global funds and portfolios are not really global funds, but two thirds shares and one third other.

The recent events may lead to many countries targeting some of these stocks in any retaliatory countermeasures, and we are already seeing consumers boycotting brands such as Tesla.

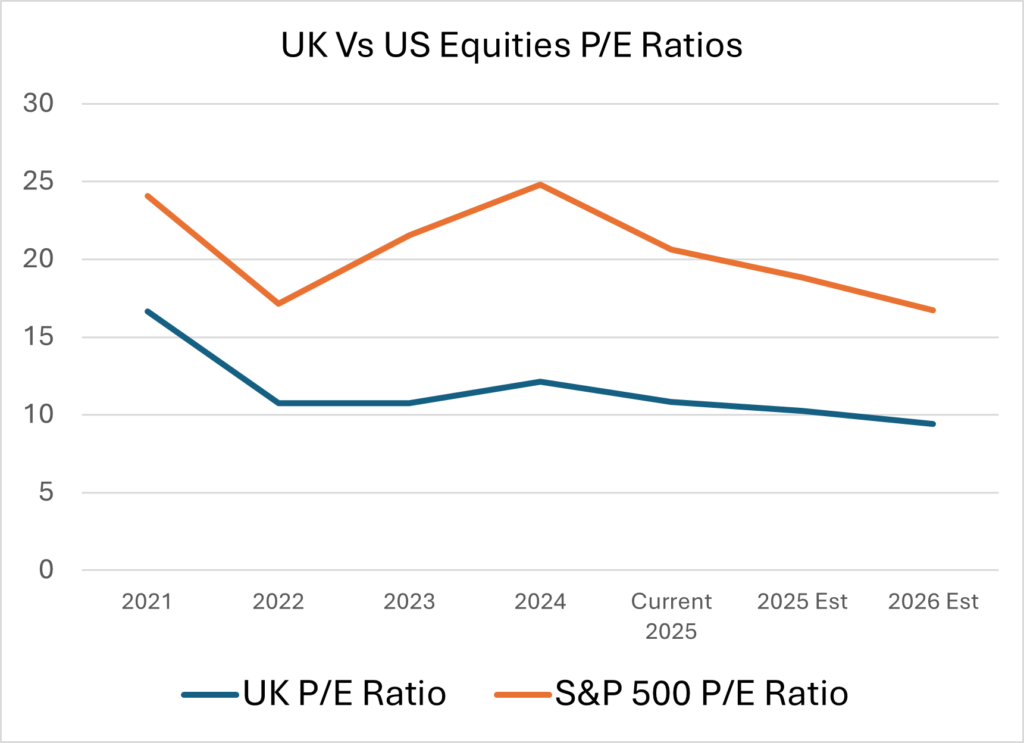

In contrast, many of other world equity markets offer a compelling case over the US. For example, UK equities offer the following:

- Valuation Discount:

UK stocks are trading at a significant discount compared to global counterparts, with some estimates indicating a 45% under-valuation. Even stripping out the differences in sectors allocations between the countries, the discount is estimated at over 20%.

- Strong Dividend Yields:

The UK market offers attractive dividend yields, appealing to income-seeking investors. The UK market has a current dividend yield of 4.05% vs just 1.5% for US equities. - Global Earnings Exposure:

Many UK companies have substantial international operations, providing diversified revenue streams. It is estimated that approximately 75% of the aggregate earnings of FTSE 100 companies are generated in foreign currencies.

Selective US Investment Approach

It is my view that whilst caution is warranted, selective investment in the US market remains viable:

- Dividend Growth Strategies:

Focusing on companies with a robust history of dividend increases can provide steady income and potential capital appreciation. - Equal Weight and Small-Cap ETFs:

These investment vehicles offer exposure beyond the dominant mega-caps, allowing for diversification and potential growth opportunities.

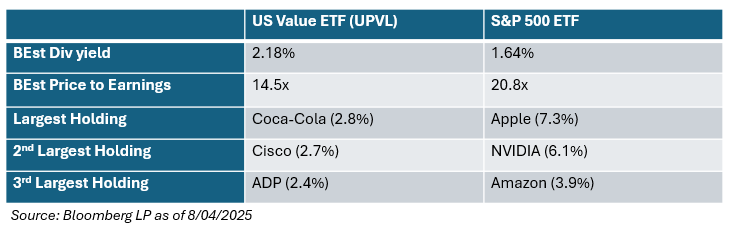

For example, our SCM Direct Portfolios do not ‘blindly’ invest in the S&P 500 due to its concentration in a handful of stocks (mainly tech). Instead, we hold a value based ETF:

Exploring Other Markets

Beyond the US and UK, other markets present attractive opportunities:

- Japanese and Emerging Market Equities:

Recent market corrections have made valuations in these regions more appealing, offering potential for growth. - UK Government Bonds:

With favourable yields and stability, UK Gilts are an attractive option for conservative investors.

The Resurgence of Value Investing – Fundamentals Remain Our Focus

The current market environment mirrors the early 2000s, emphasising the importance of fundamentals:

- Focus on Cash Flow and Valuation:

As growth slows, companies with strong cash flows and reasonable valuations are likely to outperform. - Shift from Growth to Value:

Investors are increasingly recognising the merits of value investing in the face of market volatility.

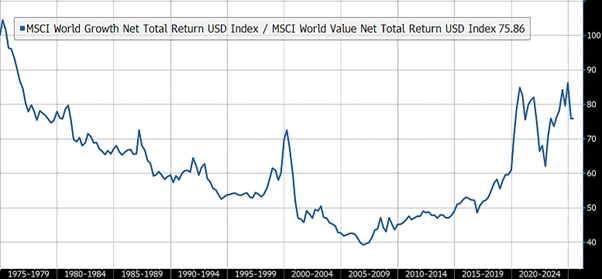

As the chart below shows, the outperformance of so called growth stocks has been more of a recent phenomenon (the last 5 years) rather than in the longer term:

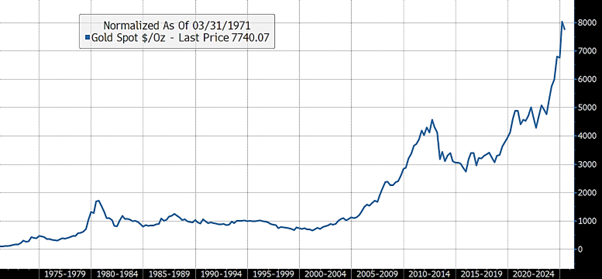

Precious Metals: Proceed with Caution

While gold has reached all-time highs, it’s essential to approach precious metals with caution:

- Potential Bubble Concerns:

Rapid price increases may indicate speculative bubbles, leading to heightened risk. - Historical Volatility:

Precious metals have exhibited significant price swings, making them less reliable as long-term investment vehicles.

As the chart shows, gold can have extended periods of 0 return – 1980 to 2007. And can fall substantially – between 2012 to 2015 it fell by nearly 40% at one point.

Conclusion

The recent market “snap” underscores the importance of a disciplined, fundamentals-based investment approach.

At SCM Direct, we’re committed to navigating these turbulent times with strategic foresight, ensuring our clients’ portfolios are well-positioned for both current challenges and future opportunities.

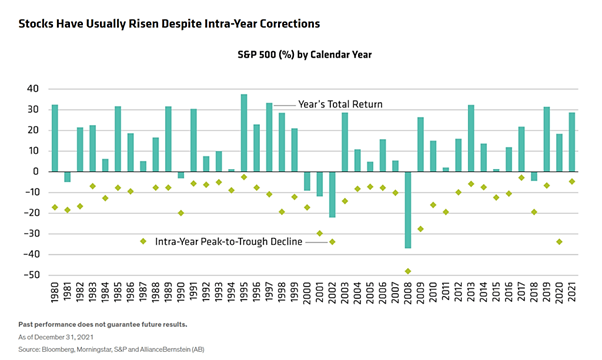

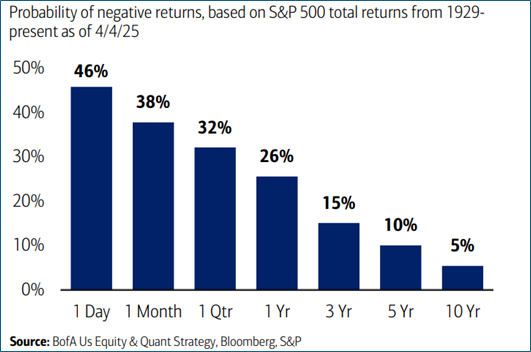

Markets are often volatile and the direction of short term movements can be the opposite to a longer time horizon as the chart below shows:

Many investors, individuals and institutions alike somehow believe they can easily trade short term movements. My 35 years’ experience as a fund manager leads me to believe this to be a very dangerous strategy.

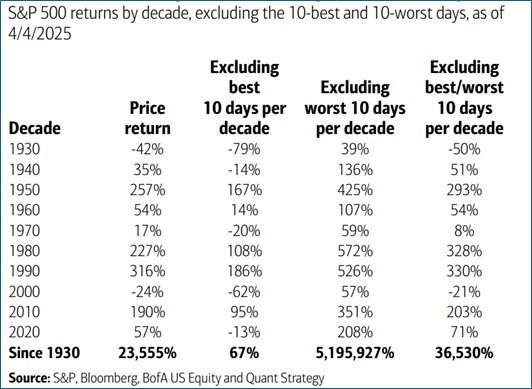

Individual major events are by their nature totally unpredictable and the lottery effect of missing just a few days each year when markets have significant moves can either supercharge or decimate returns:

Alan Miller

Chief Investment Officer – SCM Direct