The phenomenon of the “Magnificent 7” stocks – Apple, Microsoft, Alphabet, Amazon, Meta Platforms, Tesla, and Nvidia – dominating the US stock market, has captured the attention of investors worldwide. So far this year Nvidia is up 159% and had you invested in everything bar the Magnificent 7 this year your return would have been just half the overall US equity market return (+8.8% Vs +16.9%).

These tech giants have experienced exponential growth over the past decade, with their combined market value now exceeding the entire stock markets of the UK, Canada, and Japan combined.

Over the past decade, the Magnificent 7 have experienced exponential share price growth. But as the chart below shows, even Magnificent 7 stocks can go down as well as up!

Source: Bloomberg LP as of 2 July 2024

Concentration Risk and Momentum Reversals

The escalating concentration of the Magnificent 7 in indices like the S&P 500 (the main US equity index) presents a significant risk for investors. These stocks currently represent 31% of the US S&P 500 Index.

As these stocks account for a disproportionate share of the market’s return, the potential for a sudden momentum reversal intensifies. Historical data suggests that periods of high market concentration often precede major corrections or bear markets.

It is my view that investors must remain vigilant and consider strategies to mitigate concentration risk, such as reducing exposure to the Magnificent 7. While these companies have delivered impressive returns, sustaining their current growth rates may prove challenging given their already lofty valuations.

Macroeconomic Factors and Regulatory Challenges

The Magnificent 7 also face headwinds from macroeconomic factors and an evolving regulatory landscape worldwide.

Interest Rates: The market has priced in multiple interest rate cuts by the Federal Reserve. If inflation surprises to the upside and forces central banks to maintain higher rates for longer, it could spook investors and trigger a sell-off.

Anti-trust Cases: Ongoing investigations and fines, particularly in the European Union (EU), could impact companies like Google and Amazon.

Privacy Laws: Increased regulatory scrutiny on data privacy is a concern for Meta Platforms and Google.

International Regulations: New regulations in key markets like China and the EU may impose additional operational challenges.

Investors need to stay very vigilant and closely monitor these developments and assess their potential impact on the Magnificent 7’s future growth prospects.

Valuations and Fundamentals

While the Magnificent 7 have delivered stellar financial results, their current valuations appear stretched relative to historical norms and future cash flow projections.

For example:

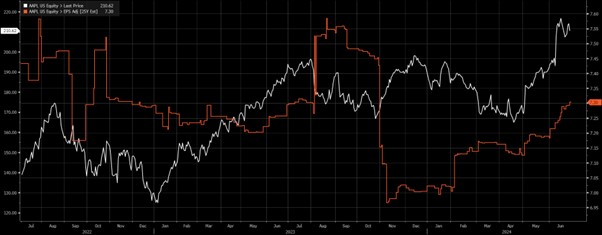

- Apple’s share price has risen 50% over the past two years (white line), despite its 2025 earnings projections falling slightly (red line) – see graph below. In its recent results presentation Apple talked about AI – which apparently now stands for Apple Intelligence! Its shares have added $600bn of market value since May 1 thanks to its June 10 announcement of a partnership with OpenAI (ChatGPT), but I’m not sure better emojis, language interpretation or editing will be a game changer.

Source: Bloomberg LP

- Tesla’s 2025 earnings projections have dropped 59% (red line), yet its stock price remained flat (white line) until a recent surge on better-than-feared deliveries. After its recent results its shares rose by 10% as deliveries were only down 5% which was better than some had feared.

Source: Bloomberg LP

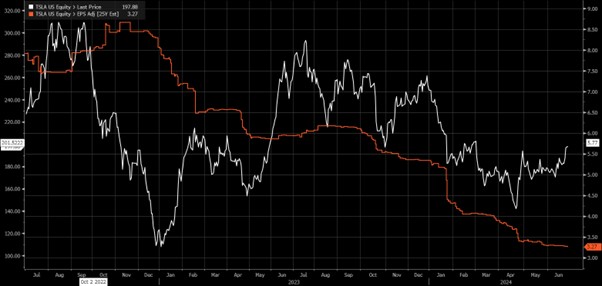

- At least for Nvidia its earnings projections have materially been upgraded (red line) and its share price (white line) has matched the rise though whether 60% margins (which inevitably have to fall) warrants such a high valuation is debatable. It seems inevitable at some point that its competitors will narrow the technology gap.

Source: Bloomberg LP

- The other major AI stock, Microsoft, which is the largest shareholder of OpenAI i.e. ChatGPT, has seen its shares rise by 71% (white line) during the last 2 years but projections for 2025 earnings (red line) have fallen slightly.

Source: Bloomberg LP

If we compare these companies’ prospective P/E multiple against the average US S&P 500 stock, the multiples are all above the market but notably this premium for virtually every stock is close to its highest level based on the last 5 years:

Source: Bloomberg LP

When you look at this year alone, and use the forward expectation of profits, you can see every single magnificent 7 stock has moved to a much higher premium compared with the S&P 500, especially the wonder stock Nvidia which now attracts an 83% higher rating relative to the end of last year.

Source: Bloomberg LP

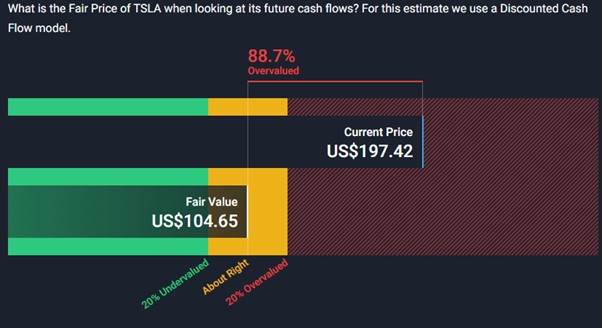

Most of these stocks can be justified by their future cashflows even if you must discount many years ahead to get the current share price. But two stocks stand out as being a long way from reality are Nvidia and Tesla. According to Simply Wall St, these stocks are hideously overvalued.

What would it mean for the S&P 500 if these three stocks were trading at the fair value based on future cashflows? My analysis shows that the S&P 500 would be 6% lower.

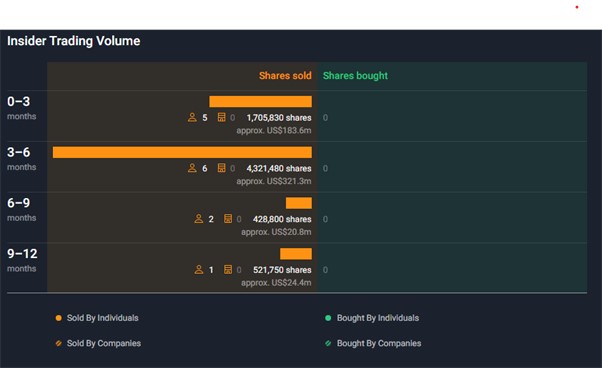

Interestingly on Nvidia there has been quite a surge in insiders selling stock recently:

Investors should critically evaluate whether these companies’ growth prospects justify their premium valuations, especially in light of the macroeconomic and regulatory risks they face.

Fund managers, as they have done so often in the past, are acting as a herd, pouring money into tech, making it there most crowded trade. But in my experience, it pays to be contrarian when taking a long term view, as you should when investing.

Conclusion

The Magnificent 7 tech stocks have shown exceptional growth and continue to lead in technological advancements.

Elevated valuations and mixed investor sentiment indicate potential risks of overvaluation and market saturation.

Regulatory challenges and macroeconomic factors present additional headwinds.

Final Thought

While these companies are likely to remain dominant players, investors should consider potential risks and market dynamics. A balanced approach, including diversification and risk management, is advisable for those investing in these high-growth stocks.

Alan Miller

8 July 2024