SCM Direct’s research into fund fees and performance was covered in an article published on Sunday 30 October entitled ‘Why expensive funds aren’t always worth the price tag’. This blog details the full research and findings that illustrate the most expensive funds consistently underperform cheaper alternatives, costing investors thousands of pounds in unnecessary fees as well as lost returns.

We analysed the primary share class of 156 IA UK All Companies funds with more than £100m under management. These funds totalled £149 bn under management (the funds analysed were predominantly actively managed funds). We calculated the total costs for each fund by adding together its reported ongoing cost to the estimated trading costs and performance fees (where charged).

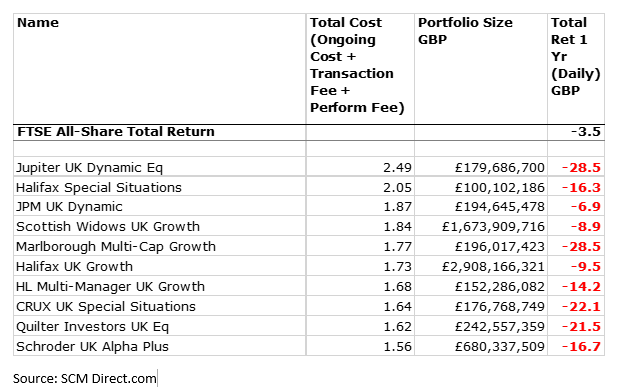

Of the 10 most expensive funds analysed, all 10 had actually underperformed the FTSE All-Share Index over the last 12 months.

The average return was -17.3%, which is nearly 14% worse than the FTSE All-Share Index return whilst the average total cost of these funds is 1.8% including performance fees and transaction costs. The lesson is that investors should look closely at total costs and think long and hard before falling for the marketing hype of many of the actively managed UK funds which simply does not stand up to close scrutiny.

We then looked at each of the 1-, 3-, 5- and 10-year performances and analysed the Total Costs against returns, finding a clear correlation between charges and performance with the cheapest funds massively outperforming the most expensive funds. There was no correlation found over a 10 year period but it should be remembered that there is a ‘survivorship bias’ whereby many funds are culled or merged away after years of underperformance, which is likely to mean that going back as far as 10 years flatters the results as many of the worst funds will have closed or merged with another.

Investors are simply not aware that when it comes to UK equity fund management, countless research (including ours) constantly shows that the more you pay, the less you get.

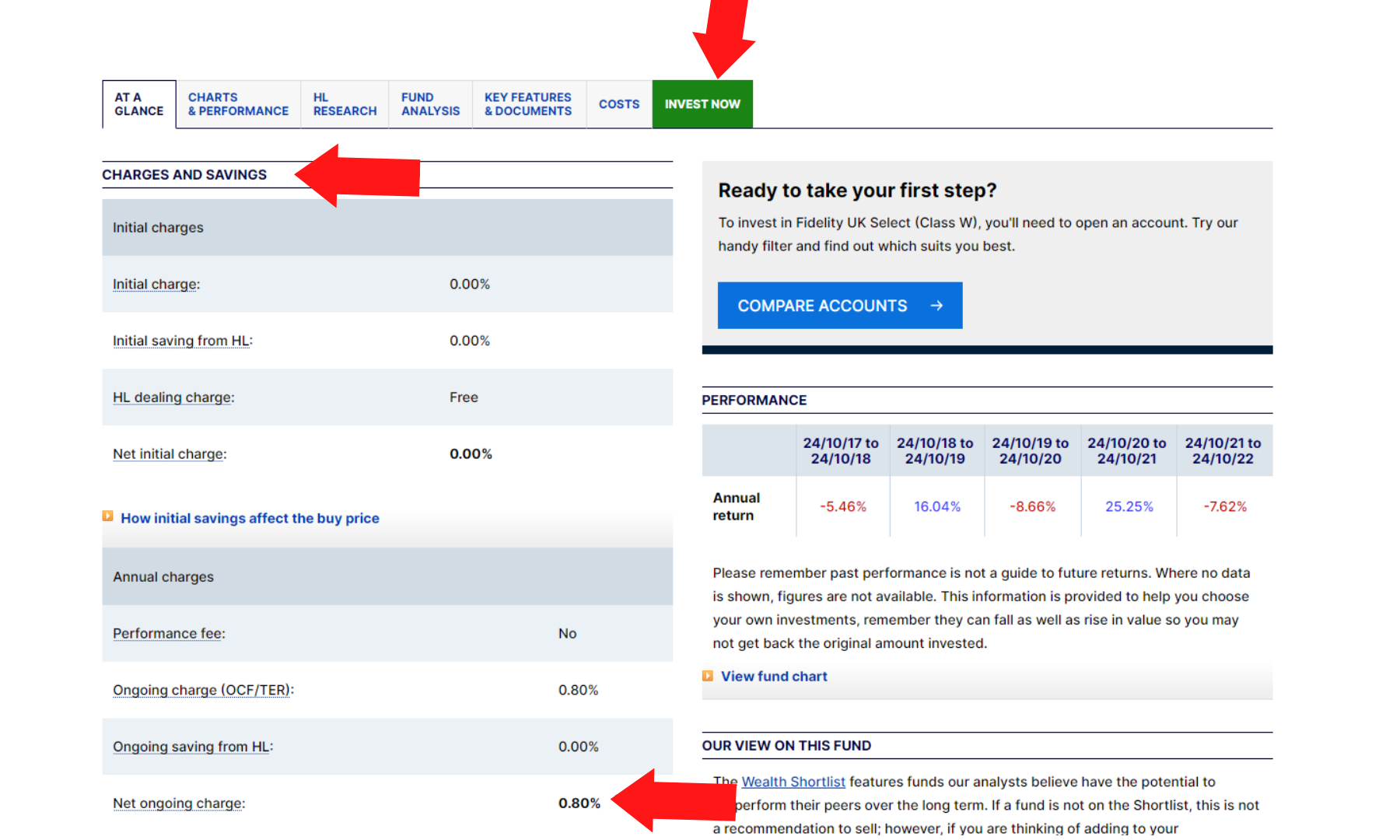

Whilst this may be counter-intuitive, investors need to check the full end-to-end costs associated with their investment managers before investing and when thinking about ‘real returns’. Despite our firm’s continual pressure on the industry and the regulator to make such total costs more prominent, it is still very difficult for investors to find in many cases. Often, the total costs are shown but only obscured in a document or part of the website rarely visited so, in effect, hidden. The FCA should mandate the form, format and that total cost must be shown in a prominent place to ensure investors can make properly informed, comparable decisions.

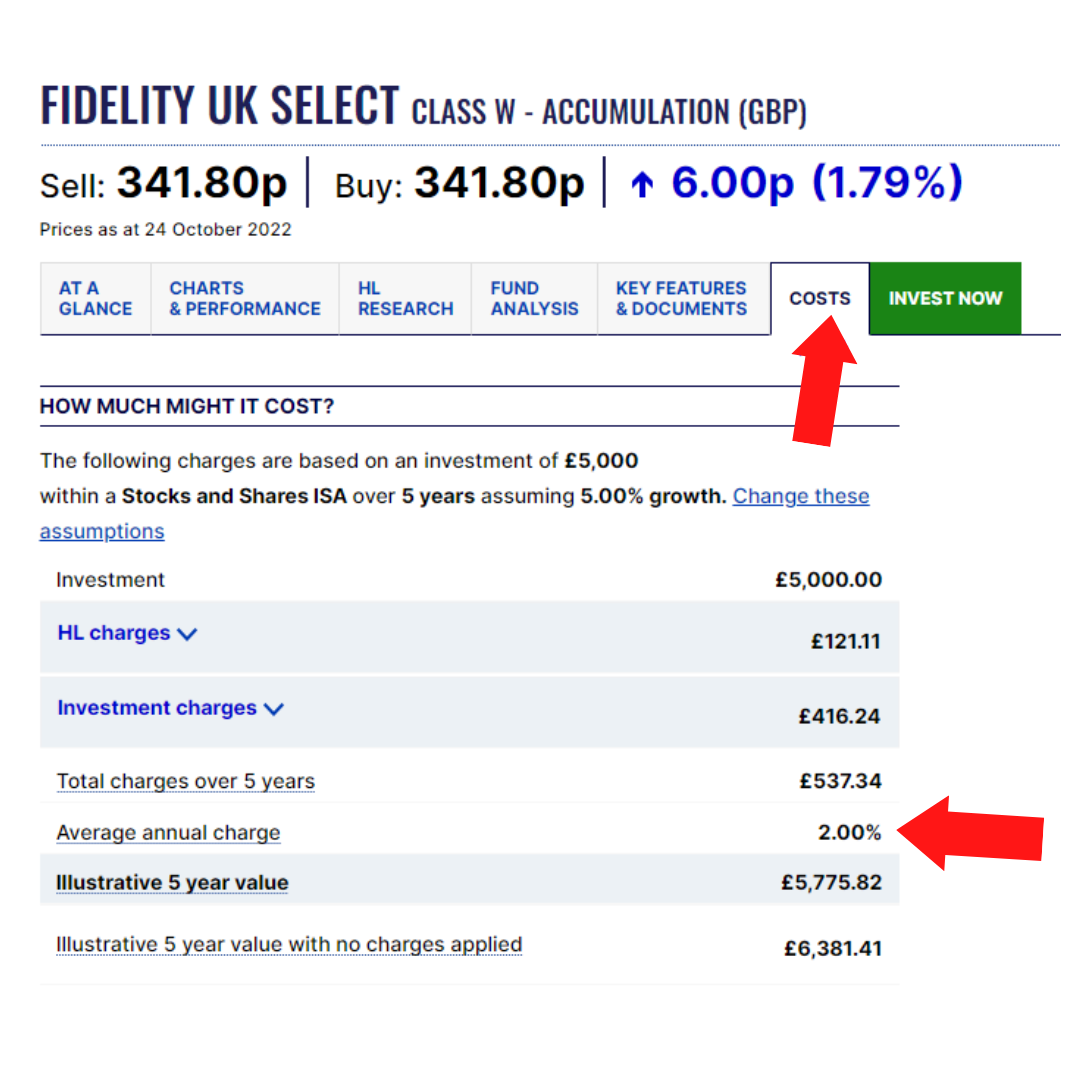

For example, if you buy a fund on Hargreaves [2] with a 1% ongoing cost, it could easily have transaction costs and/or performance fees of 0.5% which together with the Hargreaves cost of 0.45%, would mean your total cost is nearly twice the most prominent cost promoted by Hargreaves, normally the fund cost.

The £574m Fidelity Select fund has ongoing charges of 0.8% per annum, but add in the transaction costs within the fund of 0.73% per annum and the Hargreaves platform charge of 0.45% per annum, the total cost is 1.98% which is 2.5x the fund cost alone! But only if you go to the separate costs tab would you find the total is not 0.8% but 2% per annum.

Is it not time for the FCA to address this once and for all? The main sections and the invest now sections should, in our view, always show the total cost.

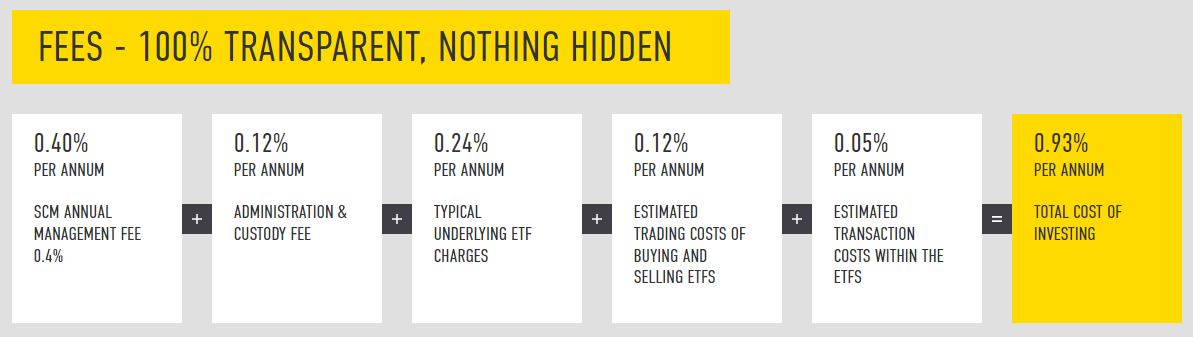

At SCM Direct, we believe clients should have 100% transparency around fees when opting for our investment products. That’s why we have a dedicated Fees page displaying the full breakdown of costs & charges, reassuring clients that there are no hidden costs, initial charges or exit penalties.

Sources:

[1] https://www.thetimes.co.uk/article/why-expensive-funds-arent-always-worth-the-price-tag-z3gfn8dx8

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest. It is therefore important that you understand the past performance is not a guide to future returns. SCM Private does not give personal advice based on your circumstances. We aim to provide investors with understandable information so they can make fully informed decisions. If you are unsure about the suitability of our investment portfolios please contact an independent financial adviser.

SCM Direct is a trading name of SCM Private LLP which is authorised and regulated by the Financial Conduct Authority to conduct investment business No. 497525.

SCM Private LLP is a limited liability partnership registered in England and Wales No. OC342778.