Despite the Biden/Harris victory in the US Elections, there appears to be group think that it will be business as usual for the US tech titans – making money with impunity.

They point to the likelihood of a Republican Senate making it less likely that the new administration will be able to implement large corporate tax increases. Unless Democrats pick off two Senate seats in Georgia which will be decided in elections on January 5 2021, Mr. Biden will have to navigate a Senate narrowly controlled by Mr. McConnell, who has turned the Senate into a graveyard for Democratic legislation.

This would severely constrain Mr Biden’s legislative and personnel agenda, dashing the hopes of those anticipating a post-Trump opening for initiatives on health care, taxes and the environment.

Big Tech were among the biggest beneficiaries of the Trump Tax Cuts of 2017 when the corporate income tax rate dropped from 35% to 21%. They believe a majority Republican Senate won’t back tough new measures to regulate these tech stocks, but in our view, they are burying their heads in the sand even though the sands are shifting.

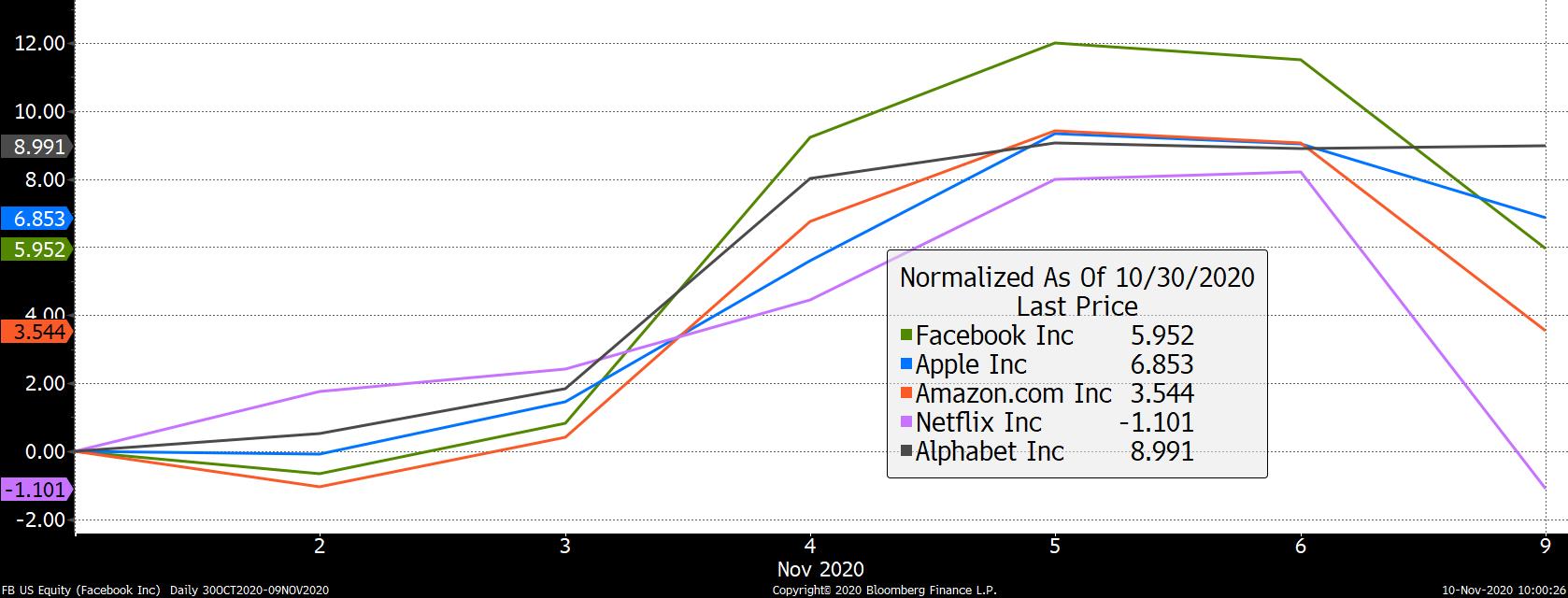

Large US tech stocks powered ahead between 5 and 10%+ immediately after the US election due to the Biden bounce, but fell back yesterday in contrast to most stock markets worldwide, which rocketed after the Pfizer announcement raised hopes of a potential breakthrough in the search for a vaccine against Covid-19:

Recently, for the first time in 42 years, the largest five US companies accounted for more than 20% of the US stock market, and all five are tech stocks – see link.

The fact is that regulation of tech seems to cross the political divide. Josh Hawley, the Republican US Senator from Missouri is passionate about Senate acting to stop what he calls “tomorrow’s Big Tech abuses”. Elizabeth Warren on the Democratic side of the Senate says it is time to break up the big tech companies because they have too much power over the economy, society, and democracy. They are accused of bulldozing competition, using private information for profit, and tilting the playing field against small businesses and stifling innovation. David Cicilline, a Democratic in the House of Representatives, leads the House Judiciary antitrust subcommittee and says the one issue that has united Republicans and Democrats in recent years is their animus toward the power of the biggest tech companies.

Their mood music appears to be escaping the ears of the stock market who are not pricing these significant risks into valuations. Only recently, the Department of Justice filed an antitrust case against Alphabet and is about to launch a case against Apple over its operation of their App Store.

For Big Tech companies, Biden still intends to impose stringent antitrust measures, as well as tough taxation and privacy regulations. Democrats say Congress should reassert that antitrust laws “are designed to protect not just consumers, but also workers, entrepreneurs, independent businesses, open markets, a fair economy, and democratic ideals.”

“The tech companies have got to be regulated in a way that we can ensure and the American consumer can be certain that their privacy is not being compromised,” Kamala Harris (New York Times)

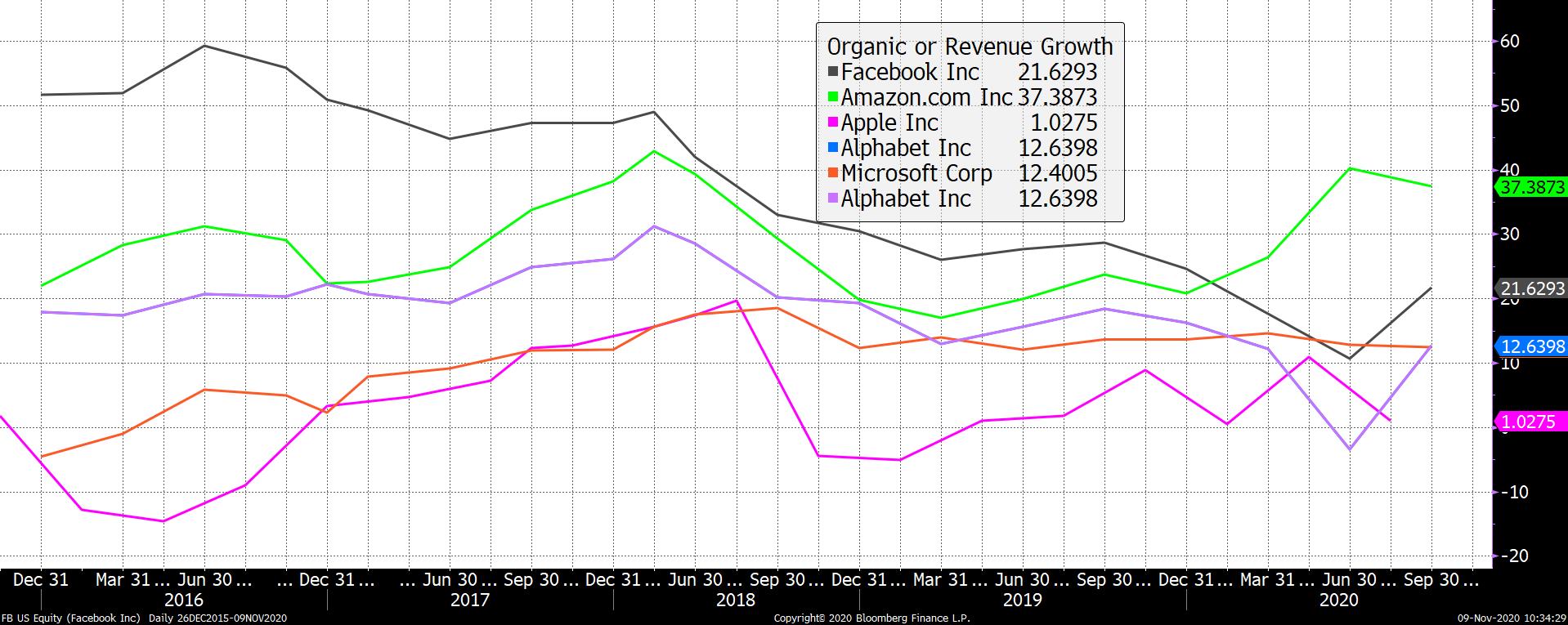

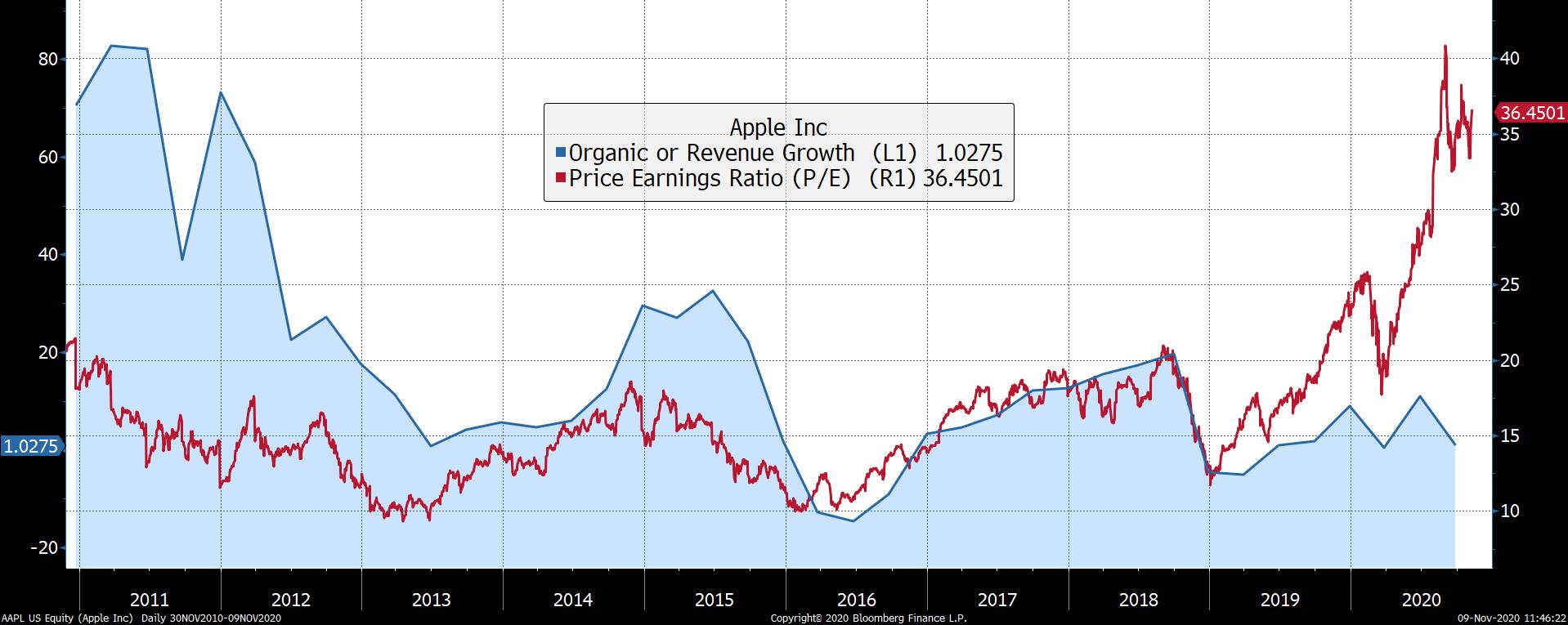

What about the fundamentals for these stocks? Their recent organic sales growth during 2020 has been impressive (with the notable exception of Apple):

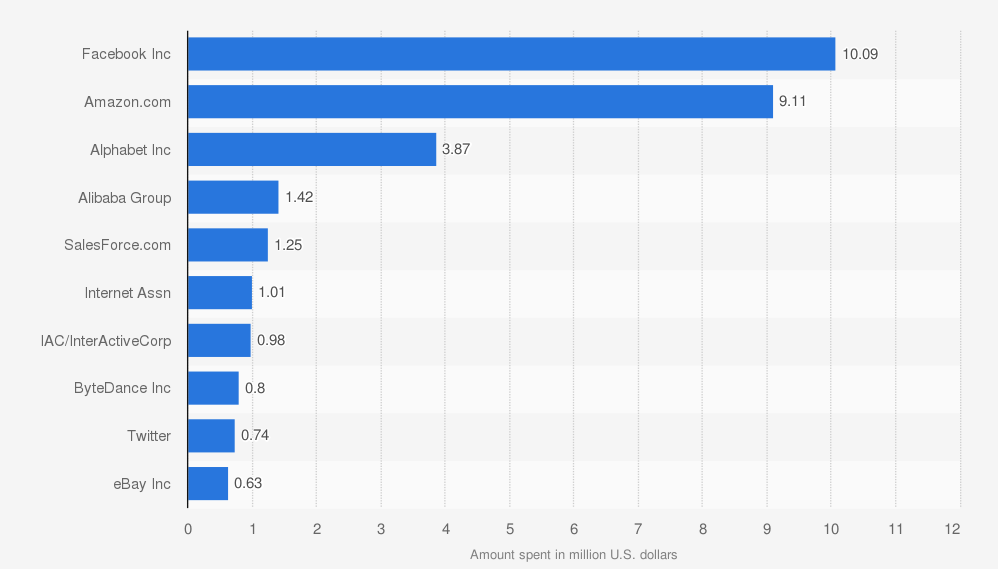

Interestingly, the two stocks with the highest sales growth are the two stocks that spend the most on lobbying – in the first half of 2020, Facebook was the internet industry’s largest lobbyist spender, spending $10.09 million.

Source: Statista – Details: United States; opensecrets.org; US Senate (Senate Office of Public Records); H1 2020; parent companies only

Recent results from the tech stocks beat expectations but most of their share prices fell sharply immediately after results. Excluding Alphabet, earning reports from the four other FAANG stocks looked good, with no major misses. However, pre-earnings exuberance appears to have caused investors to get carried away as most prices fall after beating estimates.

- Facebook, investors were concerned about higher spending levels than expected

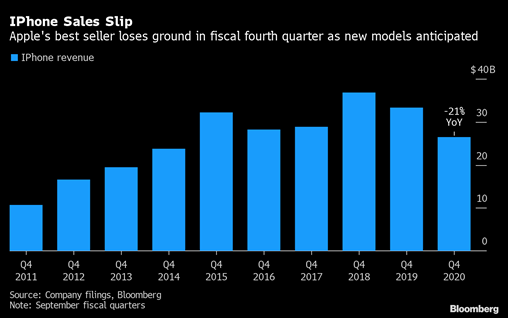

- Apple iPhone sales missed expectations, undershooting analyst expectations by c$1bn with the lowest revenue growth for the iPhone in China since 2014 and the new product buzz lessening over time:

Similarly, expectations for future revenue growth at Netflix appears to be slowing. It is now forecast to grow revenues by 18% in 2021 and 16% in 2022 as compared to 32% in 2017, 35% in 2018 and 28% in 2019:

Even this growth, would place the shares on 42x 2022 projected earnings. Interestingly, Disney is forecast to have a virtual identical sales growth in 2022 of 17% but stands on a 39% lower forecast multiple of 2022 earnings. Over the last 5 years, the share price of Netflix has risen by 369% versus just 17% for Disney.

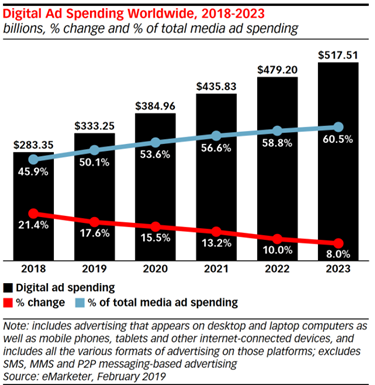

Similarly, Google (or Alphabet) is likely to see slowing growth as digital ad spending has now reached more than 60% of the market, so future growth is likely to be slower and be more dependent on overall advertising spending, rather than the growth of digital spending alone:

Conclusion

We are not saying these large tech stocks aren’t great companies, often with superior revenue and earnings growth and great cashflow. However, their share prices already capture this, but they often fail to consider the risks: slowing organic growth, eventual margin pressure, risk of greater competition and importantly tighter regulation/break ups.

In the last three days, the risks seem to have been erased from investors’ minds. If the shares were standing on a reasonable valuation, they could cope with these obstacles, but they are not.

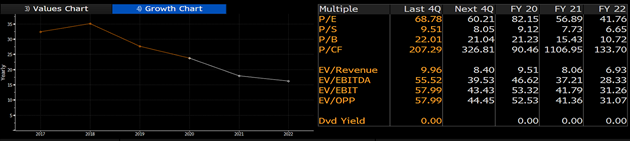

As we have pointed out, slowing growth + growing valuation tends to be a toxic combination – Apple is still the largest stock in the S&P 500 representing 6.7% of the market, but there must be a natural limit to its valuation:

Capital at Risk.

The value of investments can go down in value as well as up, so you could get back less than you invest.