To substantially outperform cash whilst aiming to reduce downside risk. Please note that whilst we aim to achieve positive returns over three-year rolling periods, there is no guarantee that such a return will be achieved over this or any other period.

Actively managed and may be all equity, all bonds or all cash. It normally invests in a wide range of ETFs to gain significant diversification and exceptional liquidity at very low cost.

| Top 10 Holdings | % of Portfolio |

|---|---|

| VANGUARD INV SER-UK GILT UCITS ETF | 11.5 |

| iShares Core UK Gilts UCITS ETF | 11.4 |

| iShares Core MSCI EM IMI UCITS ETF | 10.9 |

| Amundi UK Equity All Cap UCITS ETF | 8.9 |

| iShares Core FTSE 100 UCITS ETF | 8 |

| SPDR Sterling Corporate Bond UCITS ETF | 6 |

| Invesco GBP Corporate Bond UCITS ETF | 5.5 |

| ISHARES II PLC-USD FLTG RATE BOND U | 5.5 |

| Amundi MSCI Japan UCITS ETF | 4.8 |

| iShares Core £ Corp Bond UCITS ETF | 4.4 |

| Number of Holdings | Yield to Maturity | Maturity | Duration | S&P Rating |

|---|---|---|---|---|

| 148 Govt. Bonds 1,646 Corp. Bonds | 4.92% | 8.52 | 5.61 | A/A- |

| Number of Holdings | Best Dividend Yield Forward 12m | Best Price to Book Forward | Best P/E Ratio * | Best LTG EPS |

|---|---|---|---|---|

| 7,347 | 3.3% | 2.1 | 13.8 | 11.3% |

| Absolute Return | 5.7% |

|---|---|

| Asia Pacific Ex. Japan (MSCI Asia Ex Jap) | 13.3% |

| Em Markets (MSCI EM) | 12.9% |

| US Equities (MSCI USA) | 11.6% |

| Japan (MSCI Japan) | 10.9% |

| UK Index-Linked Gilts (Barclays UK Infl Linked) | 10.2% |

| Europe Excl UK (MSCI Eur. Ex UK) | 9.6% |

| UK Equities (MSCI UK) | 9.2% |

| UK Gilts (Bloomberg UK Govt All>1 Yr) | 6.9% |

| UK Corp Bonds (iBoxx Large Cap TRI Index) | 5.1% |

Performance is based on the monthly performance of the first client discretionary portfolio after all charges. Individual client portfolios may differ due partly to differences in the timing of initial investment or withdrawals or rebalancing. The SCM Absolute Return (GBP) Benchmark is the Barclays Benchmark Overnight GBP Cash Index. Competitor data is based on the performance of the IA Targeted Absolute Return Sector and the comparison is offered as a guide only.

| 12m to 31/01/2021 | 12m to 31/01/2022 | 12m to 31/01/2023 | 12m to 31/01/2024 | 12m to 31/01/2025 | 12m to 31/01/2026 |

|---|---|---|---|---|---|

| 3.8% | 4.6% | -2.4% | 3.4% | 8.6% | 13.5% |

Source: SCM Private LLP

| ALL Fees & Charges | Percentage |

|---|---|

| SCM Discretionary Fund Management Charge | 0.40% |

| Underlying ETF costs (KIID Ongoing Charge) | 0.14% |

| Transaction Costs of buying/selling funds | 0.12% |

| Transaction Costs within funds | 0.05% |

| Custody & Administration Fee | 0.12% |

| Total Fees & Charges | 0.83% |

No changes were made to the SCM Portfolios during January.

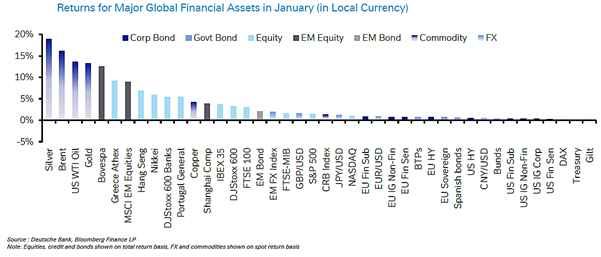

Markets began 2026 with positive headline returns, but beneath the surface, volatility has increased markedly. The S&P 500 finished January up 1.4%, while European and Japanese equities also advanced. However, this masked sharp dispersion across asset classes and sectors, and geopolitical tensions drove significant moves in commodities. Brent crude rose 16.2%, gold surged 13.3% and silver 18.9%. Yet these assets also showed how quickly safe havens can reverse. Gold fell from an intraday record above $5,500/oz to close nearer $4,900, and bitcoin fell materially from recent peaks.

The January performance table illustrates this: precious metals and energy led, while equity sectors and sovereign bonds lagged.

AI Rotation – From Euphoria to Differentiation

Investor focus has swung back decisively to AI, but with a far more critical lens. At the time of writing, since January 28, the Nasdaq has slumped 5.3%, and the Magnificent Seven are down 8.1%, with Microsoft falling 17% and Amazon 18%. Within the Russell 1000, energy equipment and semiconductors are each up around 30%, while software and healthcare technology have both fallen more than 20%.

The churn is driven by three factors. First, real-world launches are fuelling fears that AI model makers will disintermediate their customers. Logistics stocks fell after Algorhythm said its AI platform scales freight volumes by four times without extra headcount. Wealth managers’ shareprices dropped after Altruist launched an AI tool that delivers tax strategies in minutes. Since ChatGPT’s launch, physical AI infrastructure suppliers have outperformed software companies where disruption risk remains unclear.

Second, risk management is becoming more complicated. Hyperscalers are on course to exceed $700 billion in data centre capex this year, increasingly debt-funded. They borrowed $165 billion last year, with Alphabet raising $32 billion last week, including a century bond. Oracle CDS spreads have quadrupled in the past six months. Yet according to PwC, only 12% of CEOs say they have cut costs and grown revenue using AI, and US Census data suggests fewer than 18% of companies are using it at all.

Third, AI suddenly seems more imminent. Stanford’s Erik Brynjolfsson argues that US productivity nearly doubled last year to 2.7%, consistent with a “J curve” as AI investment begins to pay off. Yet with open-weight Chinese alternatives nearly as capable at a fraction of the cost, AI models may be commoditising, meaning the true value may rest in applications yet to be invented. This aligns with SCM’s positioning, as we have avoided excessive concentration in mega-cap growth stocks, and our broad geographic and sector diversification reduces the impact of sharp rotations in specific sectors or stocks.

Currencies, Policy and Risk Perception

The US dollar weakened against every G10 currency in January, down 1.4%. Gold’s rally and the dollar’s weakness reflected questions about policy credibility, even as economic data remained broadly resilient.

SCM Portfolios – Defensive and Delivering

Despite more defensive allocations, SCM Portfolios continue to perform strongly relative to peers. The equity reductions made in October 2025, along with the emphasis on high-quality government bonds across many portfolios, have reduced concentration risk without sacrificing performance.

The pullback in AI-exposed sectors and volatility in crowded trades demonstrate why diversification remains central to our approach. Markets are increasingly sensitive to valuation and positioning – conditions in which our disciplined asset allocation adds value.

Our focus remains on capital preservation, valuation awareness and global diversification rather than momentum-driven positioning.

Alan Miller, Chief Investment Officer

17 February 2026

Generating PDF...