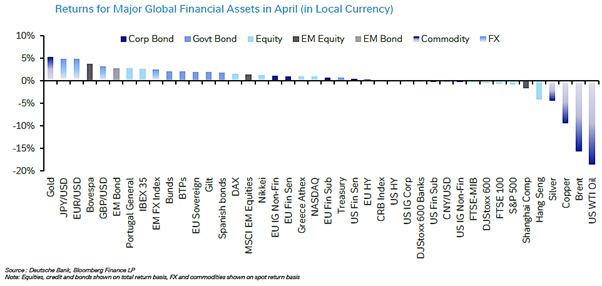

April was one of the most volatile months in markets in recent memory. The announcement of sweeping US reciprocal tariffs on April 2 triggered a rapid global sell-off, with the S&P 500 recording its fifth-worst two-day decline since WWII, falling more than 10% at its low point.

Bond markets were also rattled, with the US 30-year Treasury yield briefly exceeding 5%, and the VIX volatility index surging above 50 – levels not seen since the 2008 Global Financial Crisis and early Covid-19 pandemic.

SCM kept a cool head. Rather than reacting straight-away, we allowed volatility to play out and conducted a routine end-of-month rebalancing. This conservative, deliberative approach helped clients avoid being affected by dramatic intraday swings, ensuring their portfolios remained aligned with long-term investment goals and risk parameters.

US Tariffs, Recession Fears, and Market Whiplash

While markets partially recovered after President Trump announced a 90-day reprieve for non-retaliating countries, sentiment remained fragile. The uncertainty around tariff policy, combined with growing concern over a potential US recession, continued to dominate headlines. Market movements were further amplified by fears of retaliation from key trade partners and the knock-on effects on corporate supply chains and earnings.

Our upcoming Investment Seminar on 4 June will address this topic:

‘How a Potential US Recession and Trade Volatility May Affect Portfolios. Although headline US GDP fell -0.3% in Q1, private final domestic sales, a better measure of core demand, remained strong. This divergence reflects the fragile and mixed economic picture investors are trying to interpret. Many key indicators suggest that volatility could persist well into the second half of the year.

SCM Portfolios: Ahead of the Curve

SCM Portfolios remain conservatively positioned, with limited exposure to overvalued US tech and a strong allocation to government bonds, particularly UK gilts and US Treasuries. Our blogs, How Far Can You Stretch an Elastic Band Before it Snaps? and When the Elastic Band Snaps, continue to guide our thinking as momentum unwinds in key sectors.

Looking Ahead

As markets adjust to new geopolitical and economic realities, SCM will continue to focus on valuation discipline, risk control, and selective rebalancing. Our clients are well-positioned not just to endure volatility, but to emerge stronger from it with Portfolios that reflect quality, value, and long-term conviction.

Alan Miller, Chief Investment Officer

19 May 2025