During June, the SCM Direct Investment Team made no substantial changes to our portfolios, except for a rebalance towards the end of the month. This resulted in small additional purchases of UK and European small-cap equities and small reductions in UK and US government bond holdings (which have performed well recently) for many clients.

Rate cuts were increasingly in focus. The ECB delivered their first rate cut since the pandemic, lowering the deposit rate by 25bps to 3.75%. The Bank of Canada also delivered their first rate cut of this cycle, meaning four G10 central banks have cut rates this year. Meanwhile, the US Fed didn’t cut rates in Q2, but May’s CPI release showed the slowest monthly core CPI since August 2021. This reinforced expectations for future rate cuts from the Fed, and at the June FOMC meeting, the median dot indicated one rate cut by year-end.

The European Parliamentary elections took place at the start of June. Subsequently, French President Macron announced a snap legislative election, with the first round on June 30. This led to a notable selloff among French assets with the CAC 40 saw its worst weekly performance since March 2022.

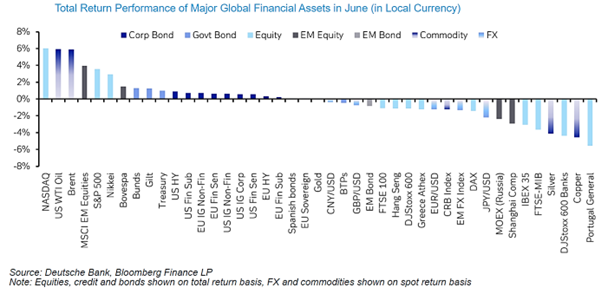

You will note from the table above that the best-performing asset in June was the NASDAQ, driven by AI stock NVidia, which rose by 12.7% compared to 3.6% for the S&P 500. Excluding the ‘Magnificent 7 stocks,’ the US market rose by just 1.4%. We recently wrote a blog on the subject, here highlighting the volatility and unsustainable valuations of these stocks.

Nvidia is highly rated by many ESG rating agencies – it is rated AAA by MSCI. This is questionable given the AI boom’s impact on water consumption for cooling data centers. Academics suggest AI demand could drive water withdrawal to between 4.2bn and 6.6bn cubic meters by 2027, equivalent to half the UK’s water consumption – see link.

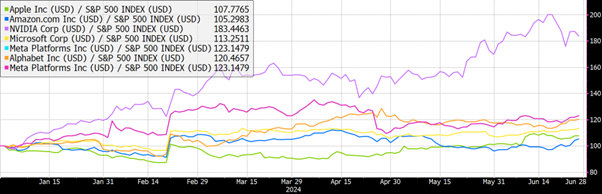

As the chart below shows, using the forward expectation of profits, every Magnificent 7 stock has moved to a much higher premium compared with the S&P 500 this year. Especially notable is Nvidia, which now attracts an 83% higher rating than at the end of last year.

Source: Bloomberg LP

When investing in bond or equity ETFs, we are mindful of exposure to individual securities, especially those with significant weighting and ‘bubble’ valuations. As of 16th July 2024, NVIDIA was 4.6% of the MSCI World Index. At the end of June, it represented no more than 0.08% of any SCM Portfolio.

Alan Miller, Chief Investment Officer, 18 July 2024.